I started with no money or plan and a dream too weird for any pitch deck. My first “funding round” was a tax refund, a leftover birthday gift, and the security deposit I never got back.

So I leaned into real-world funding sources like bootstrapping, business credit, freelance work, and selling things I probably should’ve kept.

I didn’t raise $2 million. I stretched $1,200 like it was venture capital.

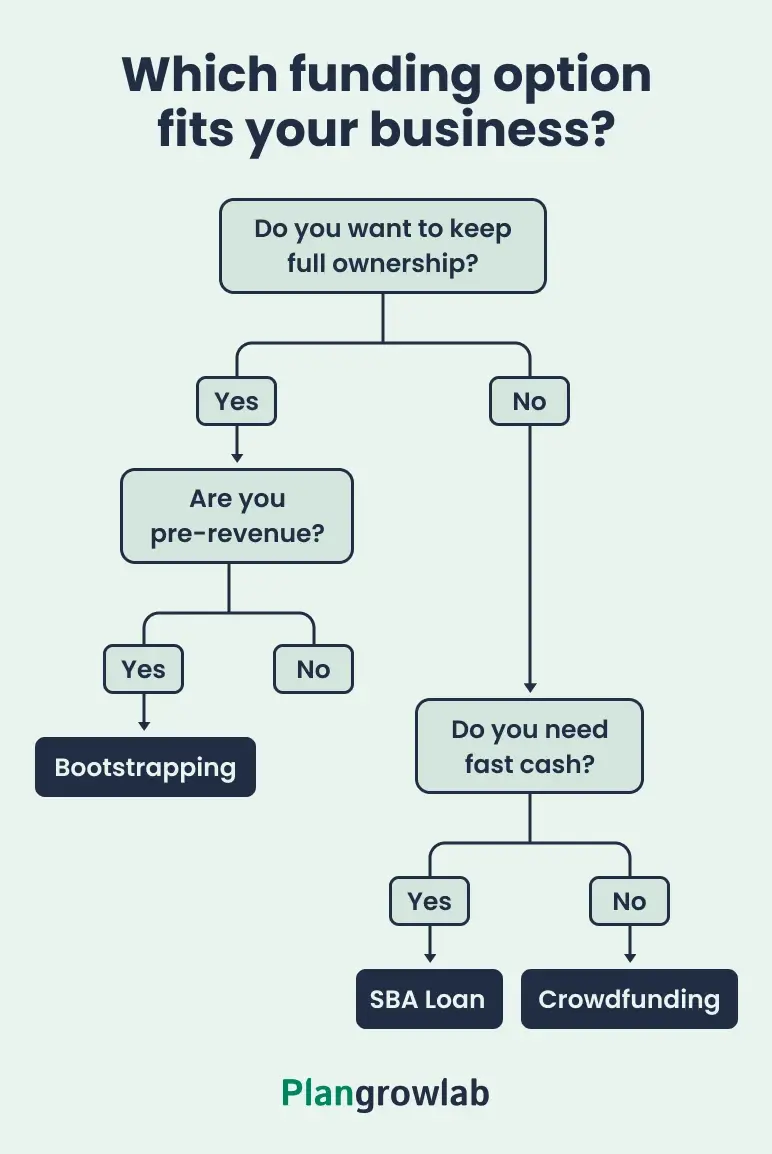

In this blog, we’ll cover the most common ways people fund their businesses, such as personal savings, bank loans, credit lines, angel investors, venture capital, crowdfunding, and grants, plus what each one really takes.

10 Common sources of funding

There are dozens of sources of funding for startups, but most fall into a few categories that keep showing up, whether you’re building a local bakery or a SaaS tool. Let’s break down the ones that founders actually use to get moving, stay afloat, or scale smart.

1. Personal savings (Bootstrapping)

For a lot of people, this is how it starts. You have an idea, a bit of savings, and the quiet hope that you won’t need much more than time and determination.

Bootstrapping means using your own savings to get things off the ground. That might be a balance from your last job, leftover student loan money, or whatever’s sitting in your “someday” account.

You don’t have to convince a lender, pitch to investors, or wait for grant approvals. You’re free to move at your own pace and build exactly the way you want.

Pros

- Helps you build sharper judgment early on.

- You stay in full control of your business strategy without outside input.

- Move faster in the early stages since you’re not waiting on formal funding processes.

- Builds founder credibility when you later raise from outside investors.

Cons

- Using your own savings limits how much you can invest in growth, hiring, or product development.

- Using your own savings limits how much you can invest in growth, hiring, or product development.

- Harder to separate personal life from business when both are backed by the same account.

- Delay in key hires or marketing pushes due to financial caution.

Need expert advice to get your business funded?

2. Bank loans (Traditional lending)

This is one of the earliest methods of financing a business. You visit a bank, you borrow money, and if everything goes well, you receive the funds upfront and pay them back in installments over time.

For most banks, what you plan to build matters less than how reliable you look on paper. They’ll look at your credit score, your income history, your collateral, and whether you’ve borrowed responsibly in the past.

Pros

- Allows you to keep 100% ownership of your business while still accessing meaningful capital.

- Once approved, you receive a lump sum upfront, which helps cover major startup costs or expansion plans.

- Terms of loans are known, so you know what you owe, when it is due, and how long it will take to repay.

- Lenders do not anticipate control over how you manage the business.

Cons

- Your credit record, collateral, and financial information are determinants for loan approval.

- You have to pay fixed amounts regardless of whether your business is earning money or not.

- The application process can be slow and involve significant paperwork.

- Interest charges can accumulate rapidly over time.

3. SBA loans (Government-backed lending)

SBA loans are a good bet for small businesses that can't get a standard bank loan. The loan itself still originates from a traditional lender, but the difference is that the government comes in to guarantee part of it.

That guarantee makes lenders feel more at ease agreeing to say yes, even if your business is new or your credit record isn't stellar.

The most popular kind is the SBA 7(a) loan. You can apply it to anything: Daily business, purchasing equipment, or even real estate purchases. It's versatile, and the terms tend to be superior to what you would receive through a regular business loan.

Pros

- More accessible to newer businesses or entrepreneurs with thinner credit histories

- Borrowers get to pay over a longer term.

- Interest rates tend to be lower than many standard business loans.

- It can be used for a wide range of needs, from everyday expenses to long-term investments.

Cons

- Requires detailed paperwork, including financial projections and a complete business plan presentation.

- Lenders still do their own checks to decide if your business is likely to make money.

- Some loans require personal guarantees or collateral.

- Waiting periods are extensive and may not appeal to many founders

Need expert advice to get your business funded?

4. Business lines of credit (and credit cards)

A business line of credit provides you with flexible access to a predetermined amount of money, which you can draw upon as necessary. You pay interest only on the amount borrowed, not the entire credit limit. When you repay what you borrowed, the money is available again, just like a credit card.

The lender or bank determines the credit limit from your company's financial history. You can use the money for short-term expenses, cash flow deficiencies, inventory, or any other operational requirement.

Pros

- Provides continuous access to capital so that you can pay for short-term necessities.

- Pay interest on what you borrow only.

- Credit cards can be used for repetitive expenditures and even earn rewards or cashback.

- Helps in building business credit profiles, making future borrowing easier.

Cons

- Lines of credit can be lowered or frozen if your financial condition changes.

- Interest rates are usually much higher than other financing options.

- Makes you prone to overspending if you don't monitor usage closely.

- Missed payments or defaults can damage your personal credit and financial standing.

5. Angel investors

Angel investors are people who put their own money into early-stage businesses they believe in. Most are experienced founders or professionals who’ve built something themselves and now want to back new entrepreneurs. It’s personal for them.

Instead of giving you a loan, they invest in exchange for equity. That makes them part owners of your company. Depending on where you are in your journey, an angel might invest anywhere from $10,000 to $250,000.

Pros

- Angel investors are often open to backing businesses that are still pre-revenue.

- Many angels bring useful experience, industry connections, or mentoring.

- Does not put debt on your balance sheet.

- The application process is usually less formal than that of banks and venture capital outfits.

Cons

- Selling equity means giving up on some part of future income and control.

- Some angel investors expect updates or involvement that may clash with your style.

- Misaligned expectations or unclear roles can create friction down the road.

- The decision-making process can be subjective and vary widely between individuals.

6.Venture Capital (VC)

Venture capital is funding provided by professional investment firms that back startups with the potential for rapid, large-scale growth. They invest in businesses that can scale quickly, reach large markets, and offer the possibility of high returns, often aiming for ten times their initial investment or more.

VCs typically look for traction before investing. That could include early revenue, fast user growth, or signs of strong market demand. They invest in return for equity, becoming partial owners of the company.

Pros

- Allows you to raise significant amounts of capital without incurring debt.

- VCs bring money, advice, and connections to help you grow.

- VC money speeds up growth beyond what organic methods allow.

- VC ties can open doors to more funding, deals, and talent.

Cons

- Giving up equity limits your decision-making power.

- VCs often push for fast growth and strict targets.

- Raising money takes time, energy, and has no guarantees.

- Missing goals after VC funding can hurt future rounds or direction.

7. Crowdfunding

Crowdfunding allows you to fundraise from many people, typically online, by presenting your idea to the public directly. Kickstarter, Indiegogo, and Republic allow you to raise money in small amounts from lots of people rather than one investor or bank.

There are a few formats to know:

- Reward-based crowdfunding provides products, early access, or rewards in return for backing.

- Equity crowdfunding enables backers to invest in your business in exchange for tiny shareholdings.

- Donation-based crowdfunding is more commonly employed by nonprofit or cause-based projects.

Pros

- You can finance without surrendering complete control or incurring debt.

- Successful campaigns validate demand and build an early customer base.

- You get publicity, feedback, and buzz that can support future launches or fundraising rounds.

- Forces you to explain your product clearly, which helps refine your pitch.

Cons

- Running campaigns takes time, planning, and constant updates.

- If you don’t hit your goal, you may not receive any funding.

- Delivering rewards can be costly and logistically complex, especially for physical products.

- Managing multiple small investors can become legally and operationally messy.

8. Grants and non-dilutive funding

Grants offer funding, usually given by governments, nonprofits, or institutions, to support specific types of work like innovation, research, job creation, or underserved communities. They’re often aimed at particular groups like women founders, minority-owned businesses, cleantech startups, early-stage researchers, and so on.

You may wait months for approval. And if awarded, there are usually conditions like: How you spend it, what you report, and sometimes what results you’re expected to show. Still, if you qualify and can wait, grants are a rare chance to get funding without giving up anything in return.

Pros

- Helps fund risky or experimental work that traditional investors often avoid.

- Winning grants boosts your credibility with future investors.

- Some grants offer extra perks like labs, university partnerships, or pilot programs.

- Grants can be renewed to stretch your runway if you show results.

Cons

- Eligibility rules can be narrow, as many strong businesses simply don’t qualify.

- Applications often take 10–40+ hours to complete.

- Grant rules may limit how you use the money.

- Delays in payout can strain your cash flow.

9. Peer-to-peer lending

Peer-to-peer (P2P) lending is a kind of financing that brings borrowers together with private lenders directly using online platforms without any interference from banks. Borrowers provide loan applications with their financial information, and lenders choose which requests to finance, either partially or in total.

Borrowers may receive multiple offers and choose the most favorable terms. Some loans are funded by multiple individuals who contribute smaller amounts. On the lending side, users search for loan requests, review credit data, and determine where to place their money.

Pros

- Borrowers can qualify more easily than with banks.

- Approval is faster and more flexible.

- Lenders may earn higher returns than normal investments.

- Borrowers can compare and choose the best loan terms.

Cons

- Rates are often higher than traditional bank loans.

- Lenders bear full risk if borrowers default.

- Platform quality and rules vary a lot.

- Offers fewer guarantees than what traditional financial institutions provide.

10. Business incubators and accelerators

Accelerators and incubators help early-stage companies through the provision of space, mentorship, and hands-on advice. Incubators tend to assist companies for a longer duration to help them nurture and experiment with ideas at a gradual pace.

Accelerators, however, are short, intense programs aimed at accelerating the growth of startups at a fast pace, frequently in exchange for equity and concluding with a demo day to showcase to investors. These are selective and will usually concentrate on a particular industry, stage, or objective.

Pros

- You get free or cheap access to space, legal help, and product support.

- Mentors and networks help you avoid mistakes and meet key contacts.

- Being in a top program boosts your visibility and credibility.

- Incubators cut costs and give room to test your idea safely.

Cons

- Getting into good programs is tough and highly selective.

- Some programs take equity, which may not suit your goals.

- Leaving the program can be hard if you rely on its structure.

- Program quality varies as some offer little real support.

There’s no shortage of ways to fund a business. But once you know what’s out there, the next step is figuring out how to move forward without wasting time or money.

Actionable funding tips for entrepreneurs

Now that we have figured out the options for funding, the big question is: How do you decide what to use, when to use it, and how to keep your business on track while doing it?

Here are a few clear, actionable tips to help you build a smarter, more flexible funding strategy.

1. Use more than one source

When you use a mix of alternative business funding options, it helps you reduce pressure, protect ownership, and keep you from depending too heavily on any single option.

You might start with personal savings and a credit card to cover setup costs, then raise a small round from friends and family, and later apply for a loan or bring on an angel investor.

2. Think for the future too

It’s easy to focus on your immediate cash needs, but funding decisions affect your next steps, too. A little planning up front can prevent a lot of scrambling later.

If you take out a loan now, will it make future investors hesitate? If you raise equity early, will you have enough room left to attract more investors later?

3. Keep your finances and credit clean

How you handle money tells investors or lenders a lot. So, the first step is to keep your business and personal finances apart. Set up a business account, track your expenses clearly, and start building out your financial records, no matter how small your business is.

4. Prepare for your ask

Before you ask for funding, ensure your pitch and business plan for investors are doing their job. That should be clear, confident, and backed by data because that’s what people look for when they decide to take a chance on you.

5. Use the money well

Some founders burn through capital and stall. Others stay focused and build real businesses with less. The difference isn't the funding size. It’s what you do with it. Treat money as fuel, not the finish line.

Need expert advice to get your business funded?

Conclusion

There’s no single “best” way to fund a business. The right source depends on what you’re building, how fast you plan to grow, and how much risk you’re comfortable taking. Some options are great for getting started, others are better for scaling, and most businesses use a mix over time.

What matters most is staying flexible. Your funding strategy should evolve with your business.

At Plangrowlab, we understand the significance of funding to your success. That is why we assist founders in becoming pitch-ready with crisp decks, concise business plans, and accurate financial projections.

Whether you're starting from scratch or need expert help with business plan writing, our team brings real-world experience and attention to detail to every project.

Frequently Asked Questions

What source of funding is used most often to start new businesses?

Personal savings are the most common. Many founders begin by investing their own money because it’s fast, flexible, and doesn’t require approval.

Can I use multiple funding sources at once?

Yes, and most businesses do. Mixing funding like savings, a credit line, and a small loan helps cover different needs without relying too heavily on one source.

How do I know which funding source is best for me?

It depends on your stage, goals, and risk tolerance. Start by figuring out how much control, debt, and complexity you’re comfortable with—then choose what fits.

Are grants worth the effort?

They can be if you’re eligible. Grants are competitive and paperwork-heavy, but they offer non-dilutive funding with no repayment, which makes them valuable when they land.