I’ve helped a lot of founders prepare for funding rounds—seed, Series A, even bridge rounds. And one thing that always comes up early is this:

“How much funding should you raise for your startup?”

It sounds like a simple question. But in my experience, this is where most founders either freeze or guess. Some ask for too little and burn out before they hit traction. Others raise too much, lose focus, or end up giving away more equity than they should.

That’s why we never start with a number. We always start with: What does the business need to hit its next set of goals?

I’ll walk you through the same method we use with our clients, step by step, so you can land on a funding amount that makes sense for where your startup is now and what’s coming next.

Founders and overfunding vs. underfunding

In our consulting work, we’ve seen both sides of the mistake. Some raise more than they need and lose control early. Others raise too little and stall out six months in. Either way, not having a clear funding strategy hurts your chances.

Let’s understand why this happens:

- Limited business experience: Many founders are navigating this for the first time, and funding strategy isn’t always straightforward.

- External pressure and market buzz: At times, investor expectations or industry hype can encourage raising more capital than necessary to make a deal seem larger or more attractive.

- Uncertain growth projections: Predicting how quickly a business will scale is tricky, and it’s easy to overestimate or underestimate future needs.

- Too many funding options: With various funding routes available, it can be difficult to choose the right type and amount for the specific stage and goals of the business.

Why is overfunding risky for your business?

Raising too much money might sound like a dream, but it can cause serious problems. Here’s why:

1) You may get comfortable soon

When there’s a big pile of cash sitting in the bank, some founders stop thinking like scrappy entrepreneurs. You may overspend on fancy offices, big teams, or unnecessary tools and forget what to prioritize.

2) You lose ownership too early

More money = more dilution.

You give away more shares than you need to. Later, when the company grows and you need serious funding, you already hold a smaller slice of your own pie.

3) It sends a bad signal to investors

If you ask for more than you need, it suggests you don't understand your business well. Smart investors will either back off or grill you hard in meetings.

In our pitch review sessions, we’ve flagged bloated asks before they go out because once the wrong number is in the deck, it’s hard to walk it back.

Now, Underfunding isn’t better either. Let’s find out the reasons.

Why is underfunding risky for your business?

On the flip side, raising too little money can starve your business and stop it from growing. Here’s why this is just as risky:

1) You run out of money too fast

You burn through your cash in 6 months when you really needed 12–18 months to hit the next big milestone.

2) You raise again under pressure

Investors can sense desperation. If you’re low on funds and scrambling to raise, you’ll either get bad terms or no offers at all. I’ve seen founders accept poor terms just to survive, and it hurts them in future rounds.

3) You lose momentum

Instead of focusing on building your product or growing your user base, you’re stuck fundraising all over again too soon. That kills energy for you and your team.

If over- and under-funding is risky, how do you avoid these traps? It’s about raising just enough to hit your next big milestone. Finding the balance is key. But how? Let’s find out in the next section.

How much funding should you raise?

From working with dozens of startups at different stages, here’s what’s worked: Raise enough to comfortably cover your burn rate, include your strategic expenses, and give yourself a 12–18-month runway. Most of the time, that means 1.5x to 2x of your projected expenses.

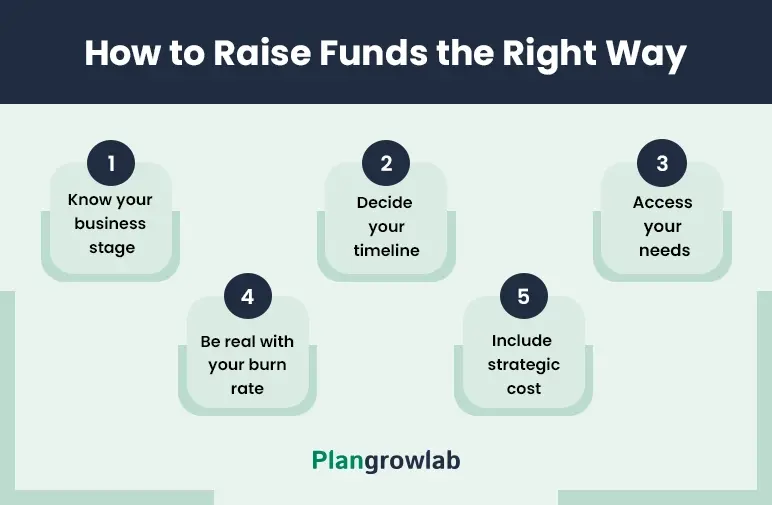

Now, let’s break down how we guide founders to figure out that exact number for your business:

Step 1: Know your business stage

Every startup is at a different point in its journey; some are just an idea, others have a product, and some are already making sales. The stage of your business determines how much money you need and what you’ll use it for.

I’ve seen founders mess this up by asking for millions when they’re still figuring out their idea or raising too little when they’re ready to grow fast. Can you imagine? Horrifying!

That’s exactly why we always ask them:

- Are you validating an idea?

- Building an MVP?

- Growing user base or revenue?

- Ready to scale?

Your answers shape what you actually need to raise. Fundraising without this clarity is just guesswork and investors can sense that a mile away.

Step 2: Be real with your burn rate

One of the first things I do with founders is help them get honest about their monthly expenses like salaries, rent, software, or marketing. It’s surprising how often people underestimate this, especially early on.

According to the survey, 1 in 5 startups fail in the first year, with running out of money being the most common reason for failure.

We’ve reviewed budgets where marketing wasn’t included, or they forgot founder salaries altogether. And six months in…they're scrambling to cut costs or raise again under pressure.

We recommend creating a detailed list that includes:

- Salaries (yes, even your own)

- Product development

- Marketing

- Tools, office space

- A buffer for surprises (because they will happen)

Making note of such expenses, you’ll know exactly how much money you need to keep the lights on, avoiding the risk of running dry.

Step 3: Decide your timeline

Your funding should last until you hit a clear milestone. This might be launching your product, doubling your customer base, or reaching break-even. But that timeline must be realistic.

We’ve helped founders work backwards:

- Set a milestone: Decide on a key business milestone, like what you want to achieve with the funding (launching your app, reaching $100,000 in sales, or hiring a key team member).

- Estimate the time: Work backwards to figure out how many months it’ll take to hit that milestone.

- Calculate funding needs: Multiply your burn rate by the number of months in your timeline, then add a buffer (e.g., 3–6 months) for delays.

- Be realistic: Things always take longer than you think. Talk to other founders to get a sense of timelines for similar businesses.

Focusing on your timeline keeps you funded and in control without any stress.

Step 4: Include strategic costs

Basic survival is not enough. You’ll also need to invest in moves that actually grow your business.

In planning sessions, we always ask: What’s the big move you’re planning in the next year? Hiring key talent? Expanding to a new region? Upgrading your product? Most forget to budget for these until it’s too late.

So here’s our tip:

Treat strategic costs as non-negotiables, not extras. Add them on top of your burn. It shows investors you’re not just thinking about surviving; you’re building to scale.

Step 5: Access your needs, not wants

This is where emotion clouds logic. I’ve seen founders either panic and lowball their ask or get overconfident and inflate it.

Before finalizing a funding target, we sit down and do a needs-vs-wants check. It’s not about what sounds good. It’s about:

- What do you need to build and test?

- What do you need to acquire customers?

- What’s truly required to reach that next milestone?

Accessing your needs will benefit you in the following ways:

- You’ll feel confident you’re raising the right amount, reducing stress and mistakes.

- A well-thought-out plan impresses investors, making them more likely to fund you.

- You’ll avoid the pitfalls of overfunding (losing control) or underfunding (running out of cash).

Ready to raise funds?

Now that you know the steps to raise the right amount of funding, it’s time to put them into action. However, remember, funding isn’t just about money. It’s about timing, strategy, and purpose.

Don’t chase big numbers to impress, and don’t shortchange your vision either. Raise what you truly need to reach your next milestone with confidence.

Nevertheless, if you need help raising funds, get in touch with our business plan consultant. They can connect you with trusted SBA lenders in our network.

Moreover, our experts at Plangrowlab can also help you craft a solid business plan, provide accurate financial forecasting, and design compelling pitch decks—all to boost your chances of getting funded.

Get in touch with our expert today!

Frequently Asked Questions

How do I know the right amount of funding to raise?

Figure out your monthly burn rate, add strategic costs, and plan for 12–18 months of runway—that’s your sweet spot. This ensures you have enough fuel to reach your next big milestone without scrambling.

Is it better to raise more funds just in case?

Not always—raising too much can lead to overspending and giving away more equity than needed. Additionally, it puts pressure on you to grow faster than you’re ready for.

What happens if I raise too little funds?

You risk running out of cash before reaching key milestones, making future fundraising tougher and more stressful. It can also shake investor confidence in your planning ability.

How much equity should I give up in my first round?

Ideally, try to give up no more than 15–25% in early rounds to retain control for future growth. Holding on to equity early helps you stay in charge as your startup scales.