Some sales forecasts are so off the mark that they do more harm than good. The numbers look impressive on paper, but they’re built on unrealistic growth rates, vague assumptions, or market conditions that no one checked twice.

What’s meant to support decisions instead creates doubt.

The issue isn’t the forecast itself. It’s how the forecast is built. A useful sales forecast, if not perfect, should be clear, reasonable, and grounded in real data. That includes historical sales performance, revenue trends, sales team input, and external factors that can actually influence results.

This guide breaks down how to forecast sales the right way, with methods that hold up in real business settings. Before anything, let’s quickly refresh…

What is sales forecasting? And why is it so important?

Sales forecasting means estimating how much your business will sell in the near future. This can be based on past sales, current deals in the pipeline, market trends, or all three. It gives you a working view of what revenue is likely to come in and when.

A clear sales forecast helps you:

- Plan cash flow and expenses without flying blind

- Back up projections in your business plan or investor pitch

- Hire, stock, and invest in growth at the right time—not too early, not too late

- Set targets that are realistic, trackable, and tied to actual performance

Done well, forecasting keeps day-to-day decisions aligned with longer-term goals. But…

Before you forecast: Gather your inputs

Sales forecasts are only as strong as the data behind them, which is why preparation matters more than most teams realize.

Here’s what to pull together:

1. Clean historical sales data

This is the base. Use past performance to map patterns over time—what was sold, when, and through which sales channels. If your historical business data is incomplete, it becomes harder to identify trends or predict upcoming shifts.

2. Revenue drivers by product or service

For each of your offerings, outline what actually drives revenue: average price, volume, discounts, or bundles. This breakdown helps link projected revenue to real business performance.

3. Segmented performance based on channels

Segment sales data by channel—retail, direct, online, partnerships. This helps you understand where growth is coming from and whether any external factors (like seasonality or marketing efforts) are affecting certain segments more than others.

4. Lead sources and CRM data (if available)

If you’re using customer relationship management tools, include lead source data, conversion timelines, and deal velocity. This is especially important when predicting sales using pipeline-based models.

Did you know?

PepsiCo has been collaborating with major retailers to share purchase data and improve forecasting accuracy. It combines retailer insights with AI technology and enhanced demand forecasting and supply chain planning, giving PepsiCo more reliable sales outcomes.

These inputs form the baseline. With them in place, calculating a sales forecast becomes a lot easier, and the numbers you generate are far more likely to reflect what actually happens next, which is…

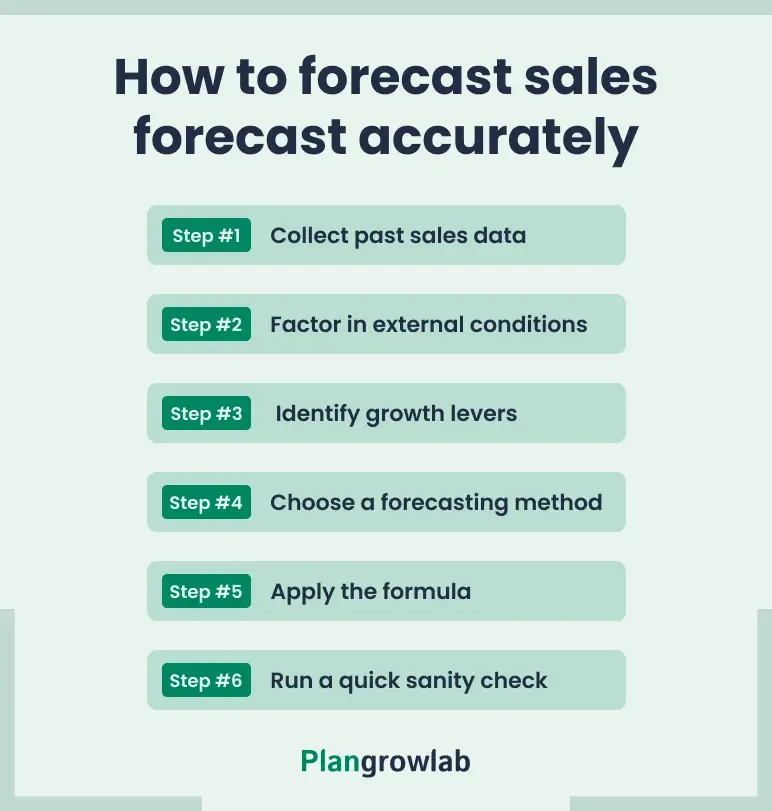

How to forecast sales forecast accurately (step-by-step)

With the right inputs in place, the forecast itself comes down to structure. Here’s how to break it down into clear, manageable steps:

Step #1: Collect past sales data

Start with sales figures from the past 6–12 months. Break it down by product or service to get a clear view of how sales is performing. This becomes the foundation for estimating future sales and spotting patterns in demand.

Step #2: Factor in external conditions

Look at internal and external shifts that could affect sales in future, like seasonal demand, pricing changes, new competitors, or changes in customer behavior. This is where industry data or even basic market research can add context to raw numbers.

Step #3: Identify growth levers

List anything that could reasonably move the forecast—new marketing campaigns, a better-performing sales team, product expansion, or improved lead quality from your sales pipeline. These elements define whether you're forecasting flat or growth-based revenue.

Step #4: Choose a forecasting method

There’s no single right way to forecast sales. Here are the main types of sales forecasting methods to choose from:

| Historical forecasting | Uses historical data to project sales and is suited for companies with stable patterns and consistent sales performance. |

| Opportunity-based forecasting | Relies on sales pipeline data, CRM inputs, and stage-by-stage win rates, making it the right fit for B2B teams tracking deals through a structured process |

| Goal-driven forecasting | Starts with a target like hitting $120K in future revenue and reverse-calculates what’s needed to get there based on conversion rates and sales capacity. |

| Lead-driven forecasting | Predicts sales based on lead volume, source quality, and how well leads have converted in the past, making it ideal for marketing-led or inbound-heavy businesses. |

| Predictive or AI-based forecasting | Uses sales forecasting software or machine learning models to analyze historical trends, market conditions, and internal and external factors. |

There’s no universal best method. The right fit depends on your process, the tools you’re using, and how much control you have over the variables.

If you’re not sure which approach fits your business or how to apply it in real terms, working with a financial forecasting consultant can help clarify assumptions, structure your data, and choose the right model.

Step #5: Apply the formula

For a basic monthly forecast:

Estimated units sold × Average price = Projected revenue

If you’re using opportunity-based forecasting:

Number of deals × Close rate × Deal value = Forecasted sales

You can also use basic sales forecasting software to automate this step and reduce manual errors.

Step #6: Run a quick sanity check

Once your sales projections are in place, take a step back. Are they realistic, given current sales? Do they account for possible risks? Sales leaders often miss this final check, and it’s where forecasts go off-track.

A viable sales forecast is accurate enough to guide planning but flexible enough to adjust as things shift.

Now that the forecasting process is mapped out, let’s look at how these steps come together in a real-world scenario.

Sales forecast example

Let’s say you sell three services: Website audits, SEO packages, and content strategy.

December’s total sales were $32,000. This figure was drawn from the previous month’s actual sales, based on clean historical data segmented by product or service.

January is expected to perform slightly better due to a New Year campaign. Based on past results and current marketing activity, the team applies a 6% growth adjustment.

Break down expected sales by product or service. The sales team, using CRM insights and sales performance trends, estimates the following:

| Product/Service | Units expected | Price per unit | Formula | Projected Revenue |

|---|---|---|---|---|

| Website audits | 25 | $400 | 25 × $400 | $10,000 |

| SEO packages | 15 | $800 | 15 × $800 | $12,000 |

| Content strategy | 10 | $1200 | 10 × $1200 | $12,000 |

| Total | — | — | (Sum of all projected revenue) | $34,000 |

We’re using the basic formula for historical forecasting:

Units sold × Price = Expected sales revenue

This formula is applied to each product or service individually to generate accurate forecasts based on previous trends and current expectations.

The projected revenue of $34,000 reflects a 6% increase over December’s actual sales. This aligns with current sales projections, marketing plans, and estimated pipeline activity. Sales leaders and sales representatives have validated the volumes.

This sales forecast supports broader decisions—budget planning, hiring, and investor reporting. Since it’s built using a structured forecasting model and verified inputs, it provides a reasonable estimate of future revenue.

Of course, even the most accurate sales forecast won’t stay accurate forever because the data behind it keeps moving. Which brings us to the next part...

Re-forecasting: When and how often should you adjust?

Reforecasting sounds like extra work, but it’s really just staying honest about your numbers. Forecasts lose value fast if they don’t reflect what’s actually happening on the ground.

Most of the time, a monthly sales check is enough. You’re not rebuilding your sales forecasting model—you’re just adjusting the details. CRM data, pipeline shifts, changes in close rates… they add up.

If your team runs on quarterly goals or has a longer sales cycle, reviewing every three months works. But if your sales strategy changes, you shift your pricing, or your team goes after a new total addressable market, re-forecast right away.

An accurate forecast doesn’t mean “perfect.” It just means useful. And the only way to keep it useful is to update it regularly.

You can tweak your forecast all you want, but when you’re planning for growth, funding, or big shifts, accuracy alone isn’t enough.

As Alan Greenspan once said:

“People don't realize that we cannot forecast the future. What we can do is have probabilities of what causes what, but that's as far as we go.”

So, instead of betting on one outcome, it’s smarter to plan for a few.

Scenario planning > prediction

One forecast gives you a plan. Three gives you flexibility. That’s why top-performing teams build multiple versions of their sales forecast.

The most common setup includes:

- Best-case scenario: If deals close faster, campaigns overdeliver, or new channels take off

- Expected scenario: Based on current trends, the sales pipeline, and realistic assumptions

- Conservative scenario: Accounts for slow-moving deals, delayed campaigns, or tighter market conditions

Each version uses the same forecasting process but adjusts inputs like close rates, deal size, or lead volume. That way, teams can estimate future sales more realistically and create a sales forecast that fits changing conditions.

Predicting future sales is helpful. But planning for a range of outcomes is what makes a sales strategy responsive and gives your team options when actual results don’t match the original numbers.

Here’s how you can still forecast future sales when you’re new to the business

New businesses don’t have historical data, so you need to lean on different inputs and a few practical sales forecasting methods.

Start with industry benchmarks. Look at how similar businesses perform in your market. It’s one of the easiest ways to create a sales forecast grounded in real numbers.

Next, consider your sales capacity—how many calls, demos, or pitches your team can realistically handle in a week or month. From there, apply average conversion rates at each stage of your funnel.

Though this approach doesn’t promise 100% accuracy, it leads to accurate sales forecasts that are realistic and useful. For startups, that’s what makes sales forecasting important. It gives you a starting point you can build on as real data comes in.

You’ve built your first forecast, even without much data. But as your business grows, so does the need for clarity. That starts with one simple question…

How detailed should your sales forecast be?

To answer that, you need to answer another question: What information does the sales forecast provide? It shows how much money your business expects to bring in from sales—month by month, product by product.

But it’s not just about totals. A good forecast also shows where those numbers come from, what’s driving them, and how reliable they are.

That’s why the right level of detail depends on where your business is and who’s looking at the numbers.

If you’re just starting out, keep it simple. Use broader monthly estimates based on capacity, industry benchmarks, or funnel conversion rates. Right now, your aim should be to create a sales forecast that’s easy to update as real data comes in. Accuracy improves with time.

If you’re a growing or mature business, investors and internal teams expect more granularity. Break down your sales forecasting by product line, region, or team, whatever gives you the clearest picture. This helps you track what's working and adjust quickly.

When you’re sharing numbers with potential investors or lenders, everything comes down to details. A strong financial projection for your business plan should be fully broken down and easy to explain.

You can build the cleanest, most detailed forecast in the world and still mess it up with a few avoidable habits. So before we wrap up, here’s a…

A few common mistakes to avoid

These aren’t complicated errors—they’re common ones that throw off your sales estimations and planning. Here’s what to watch for:

1. Forecasting without real inputs

Too many teams build forecasts without looking at CRM data, funnel conversion rates, or lead quality. Without real inputs, a sales forecast becomes a guessing exercise, not a planning tool.

2. Ignoring the link to your marketing budget

If you're forecasting growth but haven’t increased your marketing spend, something’s off. Your sales projections need to align with how much you're investing to generate leads.

3. Overcomplicating too early

New businesses don’t need advanced accounting software or a fully segmented forecast. At the early stage, simple and consistent is better than detailed and unreliable.

4. Leaving the forecast untouched for months

Sales forecasting is important, but only if it’s updated. A forecast built six months ago won’t reflect your current pipeline, pricing, or campaign performance.

5. Letting stretch goals drive the forecast

It’s fine to aim high, but your sales forecast should reflect what your team can actually deliver. Forecasting based on hope, not capacity, leads to missed targets and poor planning decisions.

Avoiding these mistakes won’t make your forecast perfect, but it will make it useful. And that’s the point.

If you’re going to forecast, do it right

There’s a big difference between a forecast that helps you plan and one that just looks good in a pitch deck. The right forecasting methods give you something better than big claims: They give you accurate sales you can stand behind.

If that sounds like something your business could use more of, Plangrowlab helps founders like you forecast sales with structure, walk you through the numbers, and make sure your projections match the real direction of your business.

Frequently Asked Questions

How far ahead should I forecast sales for my business?

Most businesses start with 12-month projections, but if you’re fundraising or planning major investments, a 3–5 year forecast is standard. Just make sure the long-term numbers are tied to clear assumptions.

What should I do if my actual sales miss the forecast by a lot?

Start by reviewing your inputs, like lead volume, close rates, and campaign performance. Then, update the forecast to reflect what’s changed.

Can I use AI tools to build my sales forecast?

Yes, AI tools can help with patterns and quick calculations, but they can’t replace strategy. For accurate sales forecasts, working with a business planning consultant gives you a better context.

Do investors actually look at my forecast in detail?

Yes, especially if you’re raising money. They’ll check for logic, consistency, and whether your sales projections are grounded in actual capacity.

How often should I update my forecast if I’m not actively raising funds?

Update it monthly or at least quarterly. Even if you’re not pitching, accurate sales forecasts help with budgeting, hiring, and decision-making. Internal clarity matters just as much as external reporting.