What is the cash flow forecasting template?

A cash flow forecasting template is a structured tool for predicting a business’s cash inflows and outflows. It helps you see how much cash you'll have at any point, so you can plan your finances and stay stable.

This template is ideal for entrepreneurs, startups, and business owners aiming to maintain a solid grip on their cash flows.

Why do you need a cash flow forecast template?

Cash flow forecasting can feel overwhelming sometimes. You might be thinking, 'Am I forgetting something?'

At that time, this template makes it simple, giving you a clear way to track your income, expenses, and future cash flow.

Here's how it helps:

Track your cash flow

Monitor your cash flow, track income and expenses while keeping your finances on the right path.

Plan for future expenses

Plan ahead for expenses—both expected and unexpected. A forecast reduces financial stress and keeps your business running smoothly.

Avoid cash shortages

Running out of cash is risky. A forecast helps you spot shortfalls early, adjust spending, or secure funds in advance to stay financially stable.

Make more informed decisions

If you keep an eye on your cash flow, you'll know where you stand financially. That way, you can plan your investments and keep your spending in check.

Best practice to use this cash flow forecasting template

Here are 7 simple steps to use this cash flow forecasting template effectively:

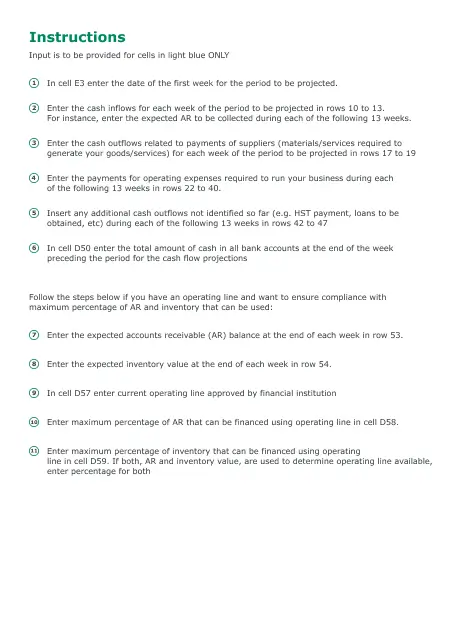

- Enter your name and contact info to download this template.

- Next, write down how much money you have right now. That’s your starting cash balance.

- Now, think about all the money coming in. Could be from sales, someone investing in your business, or anything else that adds money.

- List out everything you're spending money on. Stuff like rent, paying people, buying supplies—anything that takes cash out.

- Then, subtract what you spent from what you made (expenses from income) to know how much money you have left.

- Look it over. If something feels off or doesn’t add up, fix it so it’s accurate.

- Keep updating it regularly so you always know where your money stands.

Forecast your cash flow with ease

Use this cash flow forecast template to keep your business steady by tracking your cash flow the easy way and avoid surprises. It even helps you make better decisions with less stress.

But if you ever get stuck with forecasts or need a bit of expert advice, connect with our business plan consultants and get useful insights.

Get in Touch

Speak with an Advisor

Not sure where to start? Speak with our advisor and discuss your business goals and planning requirements.

Frequently Asked Questions

What is the meaning of cash flow forecasting? Why does it matter?

Cash flow forecasting looks at the money your business will receive and spend over time. It helps you plan for expenses, prevent cash shortages, and make better financial choices.

Is this template completely free?

Yes, this template is 100% free to download and use. You can customize it to fit your business needs.

How do I create an accurate cash flow forecast?

A simple approach to creating an accurate cash flow is:

- Write down all the money coming in, like sales, investments, or loans.

- Choose whether you want to forecast weekly, monthly, or quarterly.

- Look at previous cash flow patterns to predict future changes.

- Keep your forecast current to reflect any new income or expenses.

- If you see a cash shortage, cut expenses or find ways to boost income.

Does this template work for both startups and small businesses?

Yes, this template is adaptable for all businesses, startups, and small businesses to effectively manage cash flow.

What mistakes should be avoided when forecasting cash flows?

Here are a few common mistakes to avoid:

- Being too optimistic about sales or expenses

- Forgetting irregular expenses (like repairs, licenses, or equipment)

- Ignoring taxes or loan repayments

- Not updating your cash flow forecast regularly