Owning a franchise sounds great—until you realize how much planning goes into it. That’s exactly what Joel Libava faced. He found the perfect franchise but had no clue where to start.

When I talked to him, he shared how he went from feeling stuck to running his own business.

He also talked about his mistakes and how a simple business plan helped him figure things out.

This guide isn’t just theory—it’s real lessons from someone who’s been there.

If you’re serious about starting a franchise, explore this business plan template to start the right way.

What is a franchise business plan?

A franchise business plan is a document that explains how you’ll set up and run a franchise under an existing brand. It details your approach to managing the business while following the franchisor’s guidelines.

It shows investors your goals, financial expectations, market research, and your plan to grow the franchise. This gives clarity and direction for success.

The importance of a franchise business plan

Yeah, you’re buying an established brand, but that doesn’t mean success is automatic. You still need a plan to make it work.

Here’s why it matters:

- Keeps you from guessing – Instead of figuring things out as you go, you’ll have a clear plan to follow.

- Helps you secure funding – Lenders and investors need a clear business plan to decide if your franchise is worth financing.

- Makes running the business easier – From hiring to marketing strategies, you won’t have to make rushed business decisions.

- Helps you grow – You’re not just opening a franchise—you want it to do well and maybe even expand.

Bottom line? A franchise business plan keeps your business organized and on track. Without it, you’re just hoping for the best.

How to write a business plan for your franchise?

Here’s a step-by-step guide to writing a compelling business plan for your franchise:

1. Executive summary

An executive summary is a quick intro to your entire franchise business plan—a short, clear version that sums up the big picture.

This is the first thing investors and stakeholders will read, so it should grab their attention, highlight what makes your franchise special, and give them a reason to keep reading.

Your executive summary should cover the most important details of your plan, including:

- Franchise concept – What your business is, what it offers, and why it’s unique.

- Market opportunity – The demand for your franchise and who your target customers are.

- Company’s business model – How the business operates and what franchisees can expect.

- Financial highlights – Projected revenue, costs, and profitability.

- Investment details – Startup costs and expected returns for franchisees.

- Your experience – Why you're the right person (or team) to lead this franchise.

The primary goal of this section is to quickly show your franchise’s opportunity, financial potential, and vision.

“When I wrote my first executive summary, I tried cramming in everything—strategy, target market, financial projections—until I realized it’s just a hook, not the full story.

So, I highlighted key elements: my experience, similar franchise, and how my plan reduces risks while boosting profits. Once I kept it simple, the rest fell into place.”—Joel Libava

2. Business description

Your business description is where you tell the story behind your franchise, explain its purpose, and show why it has the potential to succeed.

Instead of just listing what you offer, explain the bigger picture:

- What does your franchise do? (Franchise Industry, services, and overall concept)

- What problem does it solve? (How does it meet buyers' needs or fill a gap in the market?)

- Why does it matter? (Why should people care? What makes it different?)

- What are your business goals? (What do you aim to achieve through your products or services?)

Use this section to highlight your strengths and make your case. Because investors and potential franchisees want to know why your franchise is a great opportunity.

“I assumed the company overview was just about what I do—own and run a franchise. But it also had to answer ‘why’ and what sets me apart. The challenge? Keeping it personal yet professional.

So, I focused on my journey into business ownership, my operations and management experience, and how I balance following a proven system with my leadership style for steady growth.”—Joel Libava

3. Market analysis

Think of your market analysis as proof that your franchise business has real demand and potential. It shows that you understand the industry, your buyers, and your competition.

Here’s what to include in this section:

- Industry overview: Market size, growth trends, and financial projections.

- Target customers: Who they are, where they are, and their buying habits.

- Market gaps & solutions: What problems exist, how your franchise solves them, and why your approach is better.

- Competitive analysis: Who your competitors are and how you stand out.

- Emerging trends: Consumer behavior shifts, new franchise opportunities, and technological advancements.

While planning this section, try to use graphs, stats, and bold numbers to highlight key points. Keep your content clear, concise, and relevant—stick to facts and avoid unnecessary details.

“At first, my market analysis lacked depth, and it showed—I missed key details. Finding reliable data wasn’t easy; online reports helped but didn’t paint the full picture.

So, I spoke with franchise owners, studied local consumer behavior, and analyzed industry trends.

That shift gave me real insights into demand, competition, and growth opportunities, making my business plan solid and data-driven.”—Joel Libava

4. Sales and marketing strategies

This part of your business plan explains how you'll attract customers and generate sales.

It’s like a bridge between you and your new customers. Even if you have the best product or service out there, it won’t sell if people don’t know about it or don’t see why they need it.

This section tells investors and partners that you’ve got a solid plan to find your audience, grab their attention, and turn them into paying customers.

Here’s what goes into a marketing and sales plan:

| Part | What It Means | Example |

|---|---|---|

| Target Audience | Who your customers are and what they care about. | Millennials who want eco-friendly products. |

| Marketing Channels | Where you’ll reach them. | Instagram, email marketing, trade shows. |

| Unique Tactics | How you’ll stand out. | Free samples, referral rewards. |

| Sales Funnel | The steps from interest to purchase. | Ads → Website demo → Special discount. |

| Revenue Model | How you’ll make money. | Subscriptions, one-time sales. |

| KPIs | How you’ll measure success. | Sales numbers, customer growth, ROI. |

At the end of the day, a strong marketing and sales strategy means you’re not just hoping people will find you—you’re making sure they do.

“My biggest challenge was marketing my franchise in a way that made it stand out. I didn’t want it to feel like just another franchise—I wanted customers to see its value.

So, I focused on brand consistency, local marketing, and customer experience. Strong branding set it apart, targeted ads reached the right people, and a great experience kept them coming back.”—Joel Libava

5. Products and services

Your products and services section clearly explains what your franchise business provides and why it matters.

This isn’t just a list—it’s your chance to show how your offerings meet buyers' needs and set your franchise apart.

Here are a few key questions to answer while drafting this section:

- What exact products or services do you provide?

- Who is your target customer?

- Where can customers buy these products or services?

- When would customers need or use them?

- How do customers access or use your offerings?

- What specific value or benefits do you provide to customers?

Additionally, focus on competitive advantage over features, showing why your offerings matter. Use real-world scenarios to make them relatable and emphasize what makes your franchise unique compared to competitors.

“The hardest part was defining my franchise approach in a way that made it stand out. I didn’t want it to sound like just another franchise, so I focused on what makes mine unique.

I highlighted how I leverage the franchisor’s proven system while bringing my expertise in customer service and local market insights.

I also made it clear that I prioritize consistent quality and customer experience over shortcuts, which helps build a strong reputation and drive long-term profit.”—Joel Libava

6. Management team and organization structure

This management team section of your business plan is more than just a list of names and titles—it’s proof that you have the right people to make a profitable business.

Here’s what you need to cover:

- What’s your business structure?

- How many people are on your team?

- What roles do they play?

- Who’s in charge of what?

- How will your team work together to grow the business?

- What experience does each person bring?

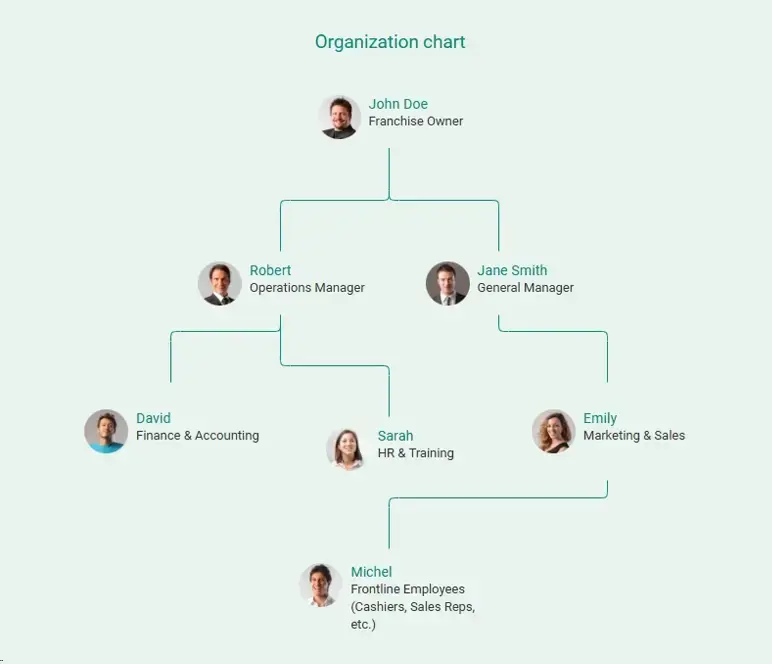

To make things clearer, here’s a simple organization chart you can use to lay out your team structure.

Showing investors a strong, capable team builds confidence and reduces concerns about risk.

“Balancing my skills with crediting my team was tricky. I highlighted my business management background—handling operations, finances, and customer relations—while also showcasing the support team, managers, and key staff.

Even part-time contributors play a vital role. Including them in my plan added credibility and showed I have the right team for success.”—Joel Libava

7. Operations plan

While other sections talk about what you want to do, this one explains exactly how you’ll do it.

The day-to-day operations must align with the standards set by the franchisor in the franchise agreement. This includes supplier relationships, marketing guidelines, and quality control measures.

Each franchisee is required to follow the operational guidelines set by the franchisor, which are detailed in the franchise disclosure document (FDD).

Here’s what to cover in this section:

- Where will you operate? (Office, factory, online convenience store, etc.)

- What tools, systems, or technologies will you use?

- What are your staffing requirements? (Hiring needs, qualifications, training)

- Who are your suppliers, manufacturers, or distributors? And why did you choose them?

- How will you control costs and manage resources efficiently?

By answering these questions clearly, you’ll give stakeholders the reassurance they need—showing them that your business isn’t just an idea, but a well-planned business operation with a real chance of success.

“Running one franchise is manageable, but multiple locations can quickly get chaotic without a solid system. I focused on staffing, initial inventory, quality control, and franchisor standards.

A structured workflow for operations, customer service, and finances kept everything on track, making it easier to scale smoothly without losing control.”—Joel Libava

8. Financial plan

Let’s talk about money—because that’s what keeps your business running.

Investors, lenders, and even franchisors want to see that your business can make a profit.

So, here are 3 main financial reports you must include in your franchise financial plan:

- Income statement

- Cash flow statement

- Balance sheet

- Break-even analysis

In addition, enclose the budget for legal fees to review the franchise agreement. Also, mention this expense to show investors you've prepared to understand franchise fees, ongoing costs, and your obligations.

“The first time I calculated my expenses, I realized I had underestimated several costs, which could have seriously impacted my bottom line.

To stay on top of it, I started using a detailed financial planning tool to monitor every expense and ensure my franchise remained profitable.

Knowing exactly what I needed to earn to cover costs and make a solid profit gave me better control over my business finances.”—Joel Libava

9. Funding requirements

If you need funds to start your franchise, this is where you explain how much you need and what you’ll do with it.

Investors and lenders may request the franchise disclosure document (FDD) to assess the franchisor’s financial history and determine the risk involved before approving funding.

Here’s what you need to include:

- Total amount needed – How many funds you’re looking for?

- Where it’s coming from – Are you using savings? Getting a loan? Bringing in investors? Maybe the franchisor is offering financing?

- How you’ll spend it – A breakdown of costs like equipment, marketing, rent, and working capital.

- How you’ll pay it back – If it’s a loan, what’s the repayment plan? If it’s an investor, what’s their cut?

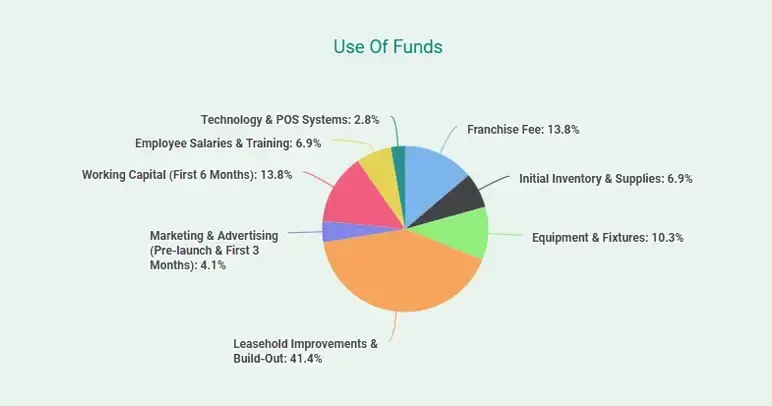

You can also include a chart illustrating how the funds raised from investors will be allocated across different expenses, as shown below.

Be clear and realistic. If you ask for too much, lenders might think you don’t know what you’re doing. If you ask for too little, you could run out of money before your franchise even takes off.

“At first, I only listed the basics—franchise fees, rent, and equipment. But lenders and investors wanted a full breakdown, including how I’d spend and how I’d pay it back.

So, I got specific. I outlined my total startup expenses, explained where the funds would come from, and showed exactly how I’d use them.

If I was taking a loan, I made sure to include a clear repayment plan. If I was pitching to investors, I detailed their potential returns. Once I had everything mapped out, securing funds became a lot easier.”—Joel Libava

Download a free sample franchise business plan

Now, are you ready to build your detailed business plan? But need a little help to get started? You’re in the right place. Here, you can download our free franchise business plan template in PDF to kickstart your journey.

This well-structured template has already helped countless franchise owners and entrepreneurs, and I hope it does the same for you. With real-life examples and key insights, you can easily create a plan that covers everything you need to succeed.

Summary

After going through this guide, you now have a solid understanding of how to create a business plan and tackle potential challenges.

But if you're feeling unsure or need expert help, our business plan consultants are here to assist you. Whether you need a full plan, a review, or professional advice, our team is ready to help.

Don’t wait—reach out to us today and get started on building your franchise!

Frequently Asked Questions

What are the key financial projections I should include in my plan?

Your plan should include essential financial projections like:

- Startup expenses

- Revenue projections

- Operating expenses

- Cash flow forecast

- Break-even analysis

- Profit & loss statement

How do I attract customers to my franchise business?

To bring in customers, you need a strong sales and marketing strategy. Here’s what works:

- Leverage the franchisor’s brand

- Local marketing

- Social media & online presence

- Loyalty programs

- Great customer service

Can I use my franchise business plan to secure funding?

Yes! Investors and lenders often require a plan before providing funding. To increase your chances:

- Clearly outline your startup expenses and how it will be used.

- Provide realistic financial projections to show profitability.

- Highlight the market demand for your franchise.

- Demonstrate your management expertise and how you’ll run the business.

What are the biggest mistakes to avoid while writing a franchise business plan?

Avoid these common mistakes:

- Skipping financial details

- Ignoring market research

- Not following the franchisor’s guidelines

- Being too vague

How long does it take to create a business plan for a franchise?

It depends on how detailed your plan is and whether you're creating it yourself or using business planning software. On average:

- DIY approach – 2 to 4 weeks, based on your research and writing speed.

- Using business planning software – 1 or 2 hours, thanks to built-in templates and guided steps.