Starting your own insurance agency? That’s a big step!

You’re stepping into a role where people count on you to feel more secure and protect what matters most—homes, cars, health, and their future.

But it’s not all smooth sailing. Things get messy, and without a clear plan, it’s easy to feel stuck or unsure of the next move. Massiel Ramirez, who now runs O.S.S Insurance Agency, experienced that early on.

I recently talked to Massiel about her journey and how she put together a plan that gave her direction and set the foundation for her agency's growth.

From those insights, I've created this guide to help you create a plan that works for you.

Why do you need a business plan for an insurance agency?

Good intentions are just a start! But they won’t pay the bills or keep your insurance agency on track.

Just like a good policy needs real coverage behind it, your business needs a plan that actually works when things get messy. Here’s how a business plan helps:

Give you clarity

A plan shows who your customers are, what makes your agency different, and how you’ll make money. It keeps you focused and on the right path.

Attract investors

If you want a loan or need financial help from someone, they’ll want to see your plan. It shows them you’re serious and ready to grow your business.

Estimate operating costs

Starting a business costs money, like paying for an office, advertising, software, and workers. A plan helps you spend your money wisely so you don’t run out too soon.

Now that you know why a business plan is important, let’s walk through the steps to create one for your insurance agency.

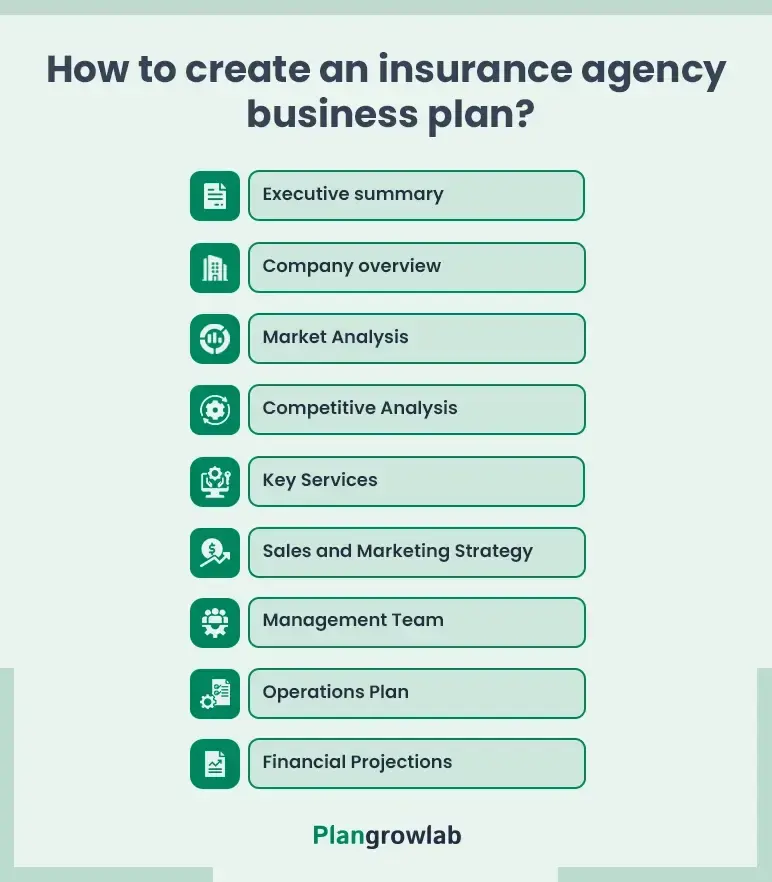

How to create an insurance agency business plan?

A good insurance agency business plan covers all the important aspects that showcase what your agency does and how it achieves its goals.

Here’s an easy 9-step guide to help you create a solid business plan for your insurance agency:

1. Executive Summary

An executive summary is the introductory part of your insurance agency business plan. It gives a short, clear overview of what your insurance agency does and why it will do well.

The primary goal of this section is to get the interest of potential investors, lenders, or partners. So, try to keep it simple, concise, and straight to the point.

While planning this section, consider including these key elements:

- Your agency’s mission and business model

- The market opportunity

- Unique insurance services you offer

- Target clients and their needs

- Competitive edge or special approach

- Your marketing plans to bring in and keep clients

- Financial outlook and growth plans

Think of your executive summary as a quick elevator pitch that clearly outlines your business and its potential for success.

"I thought writing the executive summary would be easy. It’s just a short, simple summary. But it was harder than I expected.

The hard part was explaining what makes my insurance agency special.

It’s not just about selling insurance. It’s about how I listen to my clients, explain things clearly, and help them feel confident and cared for.

That’s what really makes my agency different."—Massiel Ramirez

2. Company Overview

In the company overview section, tell the story of your insurance agency. Start with the registered business name, where you’re located, and your legal business structure.

Next, talk about why you started your agency. Did you want to help people protect their families, understand insurance, or something else? Share any big moments like getting licensed or growing your client list.

After that, explain your mission statement. Maybe it’s great service, helping people feel safe, or making things simple. Also, share where you want your agency to go in the future.

Lastly, shed light on your future goals. Do you want more clients or new services? Or maybe you want to use technology to help people more easily?

Remember, this section provides a detailed explanation of what your business is all about and what makes it unique. Hence, keep it clear, impactful, and engaging.

"It was hard for me to write the company overview without it sounding too basic or stiff.

I wanted it to show what we’re all about—helping people protect what matters to them with simple, trustworthy insurance.

I kept it simple: we want to offer reliable insurance that makes our clients feel safe and cared for."—Massiel Ramirez

3. Market Analysis

Market analysis helps you understand who needs your insurance services and what they want.

First, think about who your potential customers are. Are they families, small businesses, or individuals? What kind of insurance do they need? Like car, life, or health insurance?

Also, look for things other companies might not be offering. Maybe you can provide something they’re missing, like better plans or easier services.

Next, stay aware of emerging insurance industry trends, too. Are people looking for online quotes or affordable options? Knowing this helps you stay in the game.

Lastly, make sure you have everything set up legally, like your business license and insurance. This shows you’re professional and ready.

"I knew people needed insurance, but I had to figure out what kind of help they really wanted.

I spoke with clients and independent insurance agents. A lot of them felt confused about what coverage they needed and what choices to make.

They just wanted simple, clear options that protected the things they cared about. After hearing that, I made sure my services were easy to understand and stress-free for my clients."—Massiel Ramirez

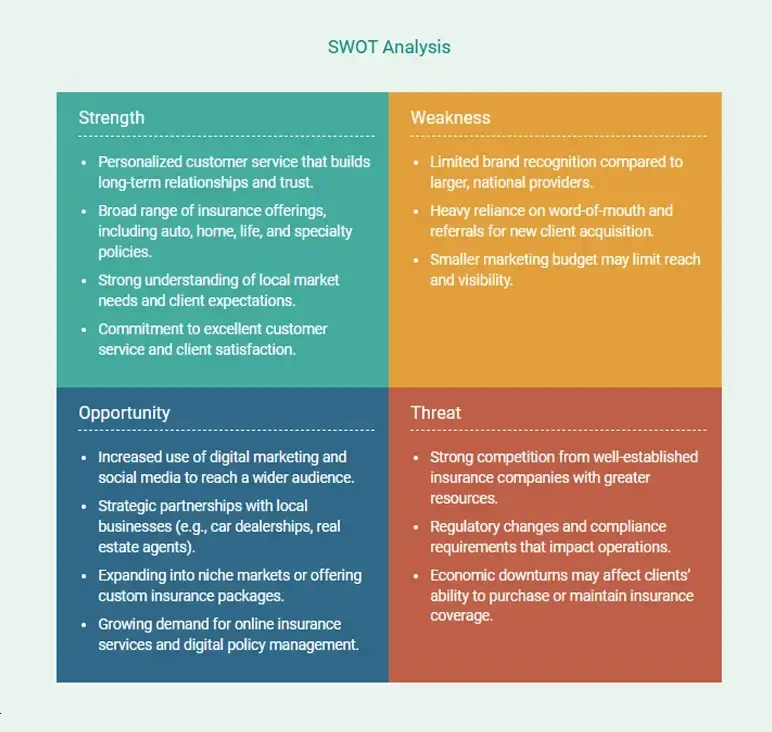

4. Competitive Analysis

Understanding your competition helps you do better in the insurance business.

Take a look at other insurance companies. What kinds of insurance do they offer? What are their pricing models? How do they treat their customers?

Further, notice what they do well, like quick service or friendly staff. Also, see where they might be lacking, like high costs or slow responses.

From that competitive analysis, decide what makes your agency different. Maybe you offer better prices, faster service, or special coverage options.

If required, do a SWOT analysis to figure out your strengths, weaknesses, opportunities, and threats, like new rules or more competition.

This will help you see what’s working, where you can improve, and how to grow or handle challenges.

"Earlier, we didn’t pay much attention to what our competitors were doing, and it ended up costing us—we missed chances to grow and lost some clients along the way.

Once we started paying attention, we saw what they were doing well and where they were falling short. That’s when we realized how to offer something better for our clients."—Massiel Ramirez

5. Key Services

This section of your insurance agency business plan is about what you’ll offer to your clients and how you’ll make money.

Start by listing the main types of insurance you’ll provide, like auto, home, life, health, and business insurance. You can also offer extras like renters’ or travel insurance to attract more people.

If applicable, describe your extra services, like giving advice, reviewing policies, or helping with claims. This can bring in more income and make your clients feel cared for.

Here’s a simple example of insurance services and how they are charged. You can refer to it while planning your own.

| Service | Description | Starting Price |

|---|---|---|

| Auto Insurance | Coverage for personal or commercial vehicles (liability, collision, comprehensive). | $60/month |

| Homeowners Insurance | Protection for homes, belongings, and liability. | $80/month |

| Renters Insurance | Coverage for rented apartments or homes. | $35/month |

| Life Insurance | Term life, whole life, and universal plans to support families. | $25/month (Term Life) |

| Health Insurance | Individual/family health plans, including dental and vision options. | $100/month per individual |

| Business Insurance | Coverage for property, liability, and workers’ comp for small/mid-size businesses. | $75/month |

| Specialty Insurance | Motorcycle, RV, boat, travel, pet, or umbrella insurance. | $15/month (varies by type) |

| Insurance Consultation | Free 30-minute session to understand client needs and coverage options. | Free (30 mins) / $50 (review) |

Be clear on how you’ll make money. Will you earn commissions from insurance companies? Will you charge for consultations or offer discounts if people buy more than one policy?

And yes, don’t forget to mention any special offers, such as online quotes or referral rewards.

“Initially, I thought just selling insurance would be enough, but I soon discovered clients wanted more—advice and assistance.

So, I began offering things like policy reviews, answering questions, and helping with claims. This made my agency feel more like a trusted friend.

I also made sure to provide flexible options, like discounts for bundling policies and easy payment plans. That’s when my agency really started to grow.”—Massiel Ramirez

6. Sales and Marketing Strategy

This section explains how you'll attract new clients, get them to choose your services, and keep them coming back. It helps you focus on what works best to grow your insurance business.

The following are some promotional tactics and sales strategies you may consider including in your plan:

Sales Strategy:

- Offer free consultations to understand client needs and discuss better options.

- Create different insurance plans for different budgets.

- Follow up with people to answer questions and guide them.

Marketing Strategy:

- Share useful tips, client stories, and success stories on your website or social media.

- Use Google Ads so people can easily find your insurance services.

- Partner with local businesses, real estate agents, or car dealerships to reach more people.

- Ask happy customers to refer friends and offer rewards for doing so.

- Show how you’ll find new clients and build your business in a simple, realistic way.

Overall, keep your sales and marketing plan simple, practical, and focused on strategies that will bring real results for your insurance business.

"I thought running ads would do the trick. But I quickly realized it wasn't enough.

What really worked was using a mix of marketing approaches, like sharing helpful tips, real stories, and testimonials online. It helped people trust me. Offering a free consultation gave them a chance to experience my services firsthand.

This made a huge difference. I gained more clients, and they were more likely to stay."—Massiel Ramirez

7. Management Team

This section introduces the key people who will help run your insurance agency.

Whether you're working alone or have a small team, a strong, well-experienced management structure will give investors confidence and help keep your business organized and successful.

So, first, describe yourself. Share your background, educational qualifications, experience in the insurance industry, and the skills that make you the right person to lead the business.

If you have a team, specify each member’s roles and responsibilities, such as dealing with client meetings, policy handling, customer care, daily work, etc.

Further, jot down their expertise and how they benefit your business to grow in the competitive marketplace.

If required, you may include an organizational chart that clearly demonstrates how each team member works together and who is reporting to whom. For instance:

If you have advisers, such as financial experts, licensed insurance specialists, or business consultants, list them as well. It indicates your business is supported and guided to grow.

"When I started building my team, I didn’t realize how important it was to clearly explain what everyone does.

At first, it felt a bit messy. But once I took the time to map out each person’s role, it all came together. It showed how we work as a team and made it easier for others, like investors or partners, to see the value we bring."—Massiel Ramirez

8. Operations Plan

A well-defined operations plan explains how your insurance agency will run every day, making sure everything goes smoothly. Hence, include all the operational intricacies of your insurance agency.

Here are a few key aspects to consider while writing this section:

Operations & Service Delivery

Explain how you’ll handle client needs, like setting up policies, renewing them, and processing claims. Mention any insurance companies you’ll work with and how you’ll track client info.

Daily Activities

List the main tasks your business will do every day, like:

- Managing client accounts

- Helping clients with questions or issues

- Selling and renewing policies

- Marketing your services

- Following insurance rules and regulations

Staffing Requirements

Talk about how many employees you’ll need and what they’ll do, like customer service, policy management, or administrative tasks. If you plan to hire specialists (like claims adjusters), mention their roles too.

Technology & Payment Processing

Describe any tools or systems you’ll use to keep track of clients and payments, like software for managing policies or accepting online payments.

"At first, I didn’t expect the busy times, and I wasn’t ready to help clients when they needed it most. This led to missed chances.

After that, I started watching for busy seasons, offering deals when needed, and building relationships with other insurance companies.

A successful insurance agency isn’t just about selling policies—it’s about staying prepared. If you don’t plan ahead, you might miss out."—Massiel Ramirez

9. Financial Projections

Your financial plan will explain how your insurance agency will make money, stay profitable, and handle financial risks.

Developing a detailed yet realistic financial plan helps you get investors, secure enough funds, and ensure your agency can succeed over time.

Here are a few key financial statements or documents that you should include for the first 3 to 5 years:

- Income statement

- Cash flow statement

- Balance sheet

- Break-even analysis

Besides these financial projections, include your start-up costs, expected income, and monthly expenses. Also, discuss how much money you need and where you’ll get it from (like loans or investors).

Finally, talk about possible risks—like changes in the local insurance market or surprise costs—and how you’ll deal with them. This helps show that your agency is ready for anything.

“When I started planning my insurance agency, the financial plan felt like the hardest part. I wasn’t sure how to estimate income, costs, or how much money I’d need to get started.

Then, I found a financial planning tool that helped me break it all down, step by step. It helped me showcase when my agency might break even and what my profits could look like.

That simple tool gave me the confidence to move forward and secure the funding I needed.”—Massiel Ramirez

Download a free insurance agency business plan template

Looking to craft your insurance agency business plan but need some guidance? We've got everything you need! Download our insurance agency business plan template in PDF to get your journey started.

This investor-ready template has helped countless insurance professionals create impactful plans. With practical examples and expert insights, it makes the process straightforward and ensures you capture all the essential details.

Get help writing a plan

Now that you’ve gone through this guide, creating a clear and straightforward business plan for your insurance agency should be much easier.

But if you’re still feeling unsure or need professional assistance, our experienced business plan consultants are here to help. They can support you with writing, reviewing, and making realistic financial projections suited specifically to your business.

Don’t hesitate—reach out to us today!

Frequently Asked Questions

What elements should be covered in a detailed insurance agent business plan?

A detailed insurance agent business plan should include the following elements:

- Executive summary

- Company overview

- Market analysis

- Competitive analysis

- Key services

- Sales and marketing strategy

- Management team

- Operations plan

- Financial projections

How do you differentiate your insurance services from others?

You stand out by offering excellent customer service and making sure your customers feel supported and informed. Whether it's focusing on a specific group like families or small businesses, or providing quick help with insurance claims, the goal is to make your agency feel personal, trustworthy, and always there for your customers.

Does an insurance business plan help me attract investors?

Yes, it does. A strong business plan shows investors that you understand the insurance market, have clear goals, and know how you’ll make money. It explains what services you offer, who your potential customers are, how you plan to grow, and what your financial projections look like. Investors want to see that you’ve thought things through and have a solid plan for success.

How can I create realistic financial projections for an insurance agency?

To create realistic financial projections for an insurance agency, follow these steps:

- Estimate how many clients you’ll have.

- Decide what types of insurance you’ll sell.

- Calculate how much commission you’ll earn per policy.

- List all monthly expenses (rent, staff, marketing, etc.).

- Compare expected income and expenses.

- Review similar businesses or talk to an accountant to keep it realistic.

Can I update my insurance agency business plan?

Yes, absolutely! In fact, updating your insurance agency business plan regularly is a smart move. As your agency grows, the insurance market shifts, or your goals change, your plan should evolve too. Whether you're expanding services, adjusting your marketing strategy, or setting new financial targets, keeping your plan current helps you stay focused and make better decisions.