Ever noticed how owning rental property seems like an easy way to make money? You buy a house, find tenants, and collect rent.

But it’s not that simple without a solid business plan!

That's what I realized when I spoke to Amanda Cornelius. We talked about how a business plan helped turn her properties into a profitable venture and avoid common mistakes.

This guide is based on that conversation and provides 8 easy steps to write a rental property business plan. But first…

What is a rental property business plan?

A rental property business plan is a detailed document that serves as a roadmap for launching and managing your rental property business effectively.

It defines your business’s purpose, identifies the type of properties you’ll focus on, and outlines key elements such as tenant preferences, financial planning, and operational strategies.

In simple terms, it’s a well-structured strategy to stay on track while navigating the ups and downs of the real estate industry.

Why do you need a business plan for a rental property?

A business plan isn’t just for getting started—it’s your key for turning a property into a reliable and profitable investment.

Here’s how it helps you:

- Understand your tenants: Who are you renting to, and what do they need?

- Set clear goals: Whether it’s steady income or expanding to more properties, a plan keeps you focused.

- Prepare for challenges: From unexpected repairs to vacancies, planning makes all the difference.

Overall, it’s your tool for staying organized, planning for growth, and ensuring your rental property doesn’t just work but thrives.

How to write your rental property business plan?

Here are the 8 easy steps to write a successful business plan:

1. Executive summary

Think of the executive summary as the front door to your business plan—it’s the first thing people see, and it sets the tone for what’s inside.

It’s a short, focused summary (about 10% of your plan) that highlights the most important details and gives readers a quick overview of your rental property business.

This is your chance to grab attention and spark curiosity about your business so keep it clear, compelling, and conversational. Highlight what makes your business unique and why it’s worth paying attention to.

For a rental property business, share the essentials:

- What kind of rental property do you have?

- Where are they located?

- Who are your ideal tenants?

- What is your long-term growth strategy?

- How do you plan to manage rental property maintenance and tenant relations?

Wrap it up with a snapshot of your financial goals, like expected rental income or any funding you need.

“When I sat down to write the executive summary, I wasn’t sure where to start. I mean, how do I highlight everything great about my rental property business without overloading it?

I knew I had to talk about things like steady demand, a growing population, and well-maintained properties, but I didn’t want to make it too long or boring.

So, I just focused on the key stuff—profitability, reliability, and how we’re meeting housing needs. Once I kept it simple, it all came together and felt way more engaging.”—Amanda Cornelius

2. Business overview

The company description is where you tell the story of your rental property agency.

This isn’t just a formality—it’s your chance to show why your business matters and what makes it stand out by including details like:

- What is your business structure?

- Who is the rental property owner?

- What does your business do?

- What problem does it solve?

- How will you make an impact?

Rental property investors want to know more than just what you offer—they want to know why it’s needed and how you’re going to make it work.

Skip the dry details and focus on the “why” behind your business—it’s what makes your story compelling.

“When I started writing the business overview for my rental property business, I wanted to keep it simple but meaningful. It’s more than just owning properties—it’s about providing reliable, affordable homes for people.

I focused on what we do, the areas we serve, and our mission to build long-term relationships with tenants.

Once I put it all together, it felt like the perfect way to explain what our business is really about.”—Amanda Cornelius

3. Market analysis

Market analysis is like having a map for your rental property business—it helps you figure out where you’re going and how to get there.

Without it, you’re just making wild guesses. Including this section in your business plan shows you’re not only ready but that you truly understand the target market.

Here’s what to cover:

- Rental property market at a glance: Share how big the target market is, the growing demand for property rentals, and where it’s headed in the future.

- Potential clients: Paint a picture of your ideal tenants. What are they looking for? What do they value in a rental?

- Market opportunities: Identify gaps in the rental property market—like the need and explain how your properties fill those needs.

- Competitive analysis: Talk about who you’re up against and what makes your properties stand out, whether it’s price, location, or unique features.

- Emerging trends: Mention rental market trends and new tech that could create opportunities.

Further, conduct a SWOT analysis to understand your business’s strengths, weaknesses, opportunities, and threats. This assessment helps you strategize and make informed decisions to achieve sustainable growth. For instance:

Also, adding the size of this rental property market and its growth trajectory shows that your rental property business has the potential to tap into a significant, ever-expanding pool of renters.

“When I started planning my rental property business, I realized that market research isn’t just about data—it’s about people.

Who are my tenants? What do they value most? Are they looking for affordability, modern amenities, or proximity to key locations? These questions shaped every decision I made.

In my target market, tenants wanted a balance of affordability and comfort, with growing interest in energy-efficient features and flexible lease options.

By understanding these needs, I wasn’t just creating a rental property—I was building a space that truly met the needs of the community I serve.”—Amanda Cornelius

4. Services offered

The services section is where you detail what your rental property business offers and why it’s valuable to your quality tenants.

This will help stakeholders quickly understand how your properties meet rental market needs and stand out in the rental property industry.

To plan this section, start by answering key questions:

- What are the primary services?

- Who’s it for?

- What unique value does it offer?

Go beyond features—focus on the benefits. For example, a prime location isn’t just convenient; it can reduce commute times for tenants. Use real-world scenarios to show how your offerings solve everyday problems.

“Beyond the basics, I wanted to offer enough features to attract a wide range of tenants, but I didn’t want to overwhelm myself with too many services.

So, I started talking to some current and potential renters, asking what they wished for in a rental property.

A lot of them mentioned they wanted more flexible lease terms and quicker maintenance responses—things they weren’t getting from larger rental property management companies.”—Amanda Cornelius

5. Operations plan

Think of the operations plan as the engine of your rental property business—it’s what keeps everything running smoothly.

This section answers the all-important question: "How will you actually make this happen?" This shows potential investors or stakeholders that you’ve thought through the practicalities and are ready to execute your vision.

Here’s what to include in your operations plan:

- Location of properties and operations base: Describe the location of your properties and your base of operations. Is there an office for managing tenant relations or a digital platform for listings and payments?

- Daily task of property management: Explain how your team will handle daily tasks like rental property maintenance, leasing, and tenant communication.

- Contractors and suppliers: Mention any contractors, maintenance professionals, or suppliers you’ll rely on, and why they’re the right fit.

- Tools and software: Highlight tools like rental property management software, payment platforms, or tenant communication apps that streamline operations.

This section reassures stakeholders that your business is built on solid, practical plans, not just ideas. A clear and detailed operational plan inspires confidence and trust in your business.

“Planning daily operations took some effort, especially figuring out how to handle maintenance and keep up with tenant communication.

I made it work by setting up a schedule for regular upkeep and creating an easy way for tenants to report issues. Honestly, staying organized is key—it’s what keeps tenants happy and stress levels low.”—Amanda Cornelius

6. Marketing strategies

The marketing strategy section is where you explain how you’ll attract tenants and turn your properties into revenue-generating assets.

Think of it as the bridge between your rental properties and your audience—it shows exactly how you’ll reach potential tenants, engage them, and convert them into loyal renters.

Here are a few key components that you should cover in your marketing and sales strategy:

| Component | Details |

|---|---|

| Target Audience | Define who your tenants are and their needs. |

| Marketing Channels | Explain how you'll reach your audience through various platforms. |

| Unique Tactics | Highlight strategies that make your marketing stand out. |

| Revenue Model | Describe how you'll generate income from your properties. |

| KPIs | Metrics you'll use to measure success, such as occupancy rates. |

This section proves to stakeholders that you’ve got a clear, practical plan to market your rental property rentals effectively and fill vacancies.

The tricky part was standing out in such a crowded market. So, I focused on using professional photos, showing off the best features, and offering move-in specials.

Investing in great visuals really made a difference.”—Amanda Cornelius

7. Organization and management team

The management team section introduces the rental property owner, property manager, and the other people who will run the rental property business, whether it’s just you or a small team.

This will provide a clear picture of how your business is structured and how the team operates.

Here’s what you need to cover:

- Who’s the rental property business owner?

- How many members are on your team?

- What roles do they play?

- Who holds which position? Who’s the property manager?

- How will the team work together?

- What experience do they bring?

Providing this detailed information gives stakeholders confidence in your business and reduces doubts about potential risks.

Further, you may consider including a visually appealing organization chart to showcase the hierarchical structure and how key roles are interconnected.

“Since I’m currently managing the business on my own, I initially worried it might seem like I lacked sufficient support.

However, I realized the property management team section isn’t about having a large team—it’s about demonstrating that I have the skills and experience to run the business effectively.

I focused on showcasing my strengths, such as my expertise in rental property management, my ability to handle maintenance and tenant relations efficiently, and my proven track record of keeping properties well-maintained and tenants satisfied.”—Amanda Cornelius

8. Financial plan

The financial plan is where you show how your rental property business will make money and grow sustainably.

This section gives investors confidence by proving you’ve thought through the numbers and planned for success.

Start by explaining your revenue model—whether you’ll focus on long-term leases, short-term property rentals, or a combination of both. Be clear about how your business will generate passive income.

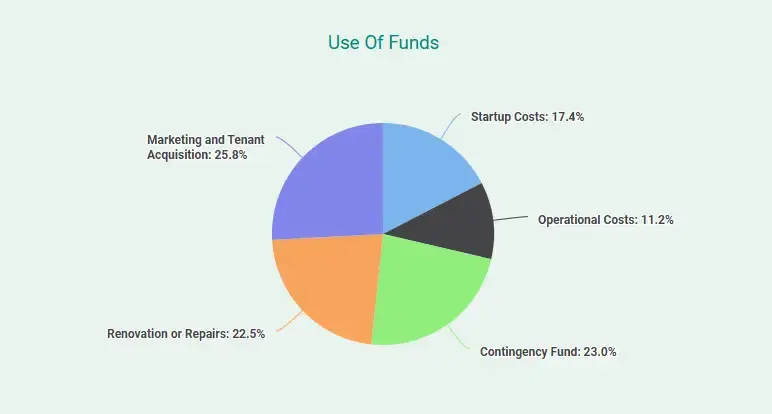

Next, outline your funding needs. If you’re seeking a loan or initial investment, specify how much you need and how you’ll use it, such as for rental property purchases, renovations, or marketing.

Moreover, include financial documents like an income statement, cash flow statement, a balance sheet, and break-even analysis to provide a snapshot of your business’s financial health.

If required, address potential risks, like vacancies or unexpected expenses, and share your strategies for managing them. A strong financial plan shows you’re ready to handle challenges and sets your business up for long-term success.

“The financial plan took the most time to figure out. Estimating costs like rental property purchases, repairs, and maintenance was pretty straightforward, but projecting income was trickier.

I broke it down into monthly rental income and property management fees to make it clearer.

My advice? Always leave room in your budget for unexpected expenses—they come up more often than you’d expect.”—Amanda Cornelius

Download free rental property business plan template

So, are you ready to start writing your rental business plan from scratch? Need some extra help with that? Don’t worry—download our free rental property business plan template in PDF to get started.

This template has helped countless entrepreneurs launch their businesses successfully. With practical insights and examples, it guides you in creating a plan that covers all the essential details. Simply download it and customize it to suit your business needs.

Get help writing your business plan

Let’s wrap things up! We’ve covered all the basics of writing a business plan and provided tips to help you navigate the common challenges in business planning.

Still feeling unsure or need expert guidance? Connect with our top business consultants. From business plan writing, reviewing, and consulting to financial forecasting, Our experienced professionals give you the support you need.

Wait no longer; start crafting a plan that stands out to investors!

Frequently Asked Questions

What should be included in a rental property business plan?

Your business plan should include:

- Executive summary

- Business overview

- Market research

- Competitive analysis

- Marketing strategy

- Operations plan

- Management team

- Financial plan

How does a rental property business plan help you secure funding?

A good business plan shows lenders and real estate investors that you’ve done your homework. It outlines your strategy, rental market potential, and financial projections, giving them confidence in your ability to generate steady income and repay loans or provide a return on their investment.

Is hiring a business plan writer worth it for a cleaning business plan?

Yes, hiring a business plan writer can be worth it for a cleaning business plan if you need a polished, investor-ready plan and lack the expertise to create one yourself.

However, if you’re confident in your research and writing skills, using templates or software is a cost-effective alternative.

How much does it cost to write a rental property business plan?

The cost of writing a business plan can range from $7 (or even free) to as high as $25,000, depending on whether you do it yourself, hire a professional, or use business planning software.