Turning your passion for numbers into a thriving tax preparation business is exciting!

But just like filing a complex tax return, success takes more than expertise — it needs a clear plan.

Recently, I spoke with Natalie Cunha, owner of Nat's Tax Service. She found writing a business plan overwhelming at first, but with focus and the right approach, it became her roadmap to stay organized and grow.

Inspired by her journey, we’ve created this simple guide to help you craft a tax preparation business plan that works.

Let’s get started!

What is a tax preparation business plan?

A tax preparation business is a simple guide to start, run, and grow your tax service business.

It outlines your business goals, the services you offer, your target customers, and your marketing strategy. It also covers your pricing, finances, and daily tasks to keep things running smoothly.

Overall, it’s a clear plan to stay organized, focused, and ready for anything as you build a successful tax preparation business.

Why write a business plan for tax preparation service?

A tax preparation business plan is more than just a document – it’s a simple guide that helps turn your business idea into a successful reality.

Here’s why it matters:

- It helps you set goals, whether you start small or plan to grow your client list.

- It shows investors or lenders that you have a plan and know what you’re doing.

- It helps you find problems early and come up with solutions.

- It keeps you on track so you can check your progress and adjust your strategies when needed.

A detailed business plan keeps your tax preparation business focused, organized, and ready to grow over time.

Key components of a tax preparation business plan

A well-structured tax preparation business plan highlights your goals, services, and strategies for success. It helps define your vision and attract potential investors or partners.

Let’s break down the essential elements of your business plan:

1. Executive Summary

The executive summary is the first part of your tax preparation business plan. It highlights the key points of your business and gives a quick overview of what you do.

This section sums up the whole business plan and is designed to catch the interest of potential investors, partners, or lenders. It should be clear, brief, and impactful.

Here’s what to include in this section:

- Business model and vision

- Market opportunity

- Target market

- Unique services and value

- Marketing strategies

- Financial projections

Think of the executive summary as your "elevator pitch" — a quick, strong explanation of what your tax preparation business is all about and why it stands out from the competition.

"I thought writing my executive summary would be the easiest part — just a quick recap of my business. But when I sat down to do it, I realized the real challenge was more than listing my tax-related services.

It was about capturing what makes me different — the trust I build with clients, the personal touch I bring, and the genuine care I put into every interaction. That’s what truly defines my business."—Natalie Cunha

2. Company Overview

In this section, share your tax business story. Start with your business name, location, and legal structure (sole proprietorship, LLC, or partnership).

Talk about how your business began—what made you want to start helping people with their taxes? Was it your love of numbers, your desire to support small businesses, or something personal?

Mention any highlights or achievements, like getting certified, growing your client list, and building a partnership.

Then share your mission—what values do you work by? Maybe it’s accuracy, honesty or giving clients peace of mind about their finances. Also, describe your vision—where do you see your business in the future?

Finally, share your short and long-term goals. Maybe it’s getting more clients, offering new services like tax planning or audit help, or using technology to make tax filing easier and safer for everyone.

Keep it simple, real, and clear. Let your story show what makes your tax business unique!

"Defining what made my tax preparation business unique wasn’t easy at first. I knew offering accurate and reliable tax preparation services was important, but so many businesses do that.

The turning point came when I realized my clients weren’t just looking for someone to file their taxes — they wanted someone they could trust, who would listen to their financial concerns and guide them with care.

That’s when I understood my work wasn’t just about numbers — it was about helping people feel confident and secure in their financial future."—Natalie Cunha

3. Service Offerings

This section highlights what your tax preparation business does and how you help individuals, small business owners, and entrepreneurs with their taxes.

Start by listing your services, such as preparing tax returns, giving tax advice, and helping with IRS issues.

Here are some tax preparation services you may include:

If you offer additional services, such as accounting services, helping freelancers with quarterly taxes, advising new business owners on tax requirements, or setting up IRS payment plans, mention those, too.

Finally, how much do you charge? Flat fee, hourly rate, or custom pricing based on each client's needs? Be transparent with your pricing so clients know what they get.

“While outlining my tax preparation services, I realized it wasn’t about listing everything I could possibly offer — it was about focusing on what truly matters.

I shifted my approach to highlight the services that bring the most value to my clients, like helping them save money, stay compliant, and plan for their financial future.”—Natalie Cunha

4. Market Research

Doing market research helps you understand the tax preparation industry and your local market. It guides your business decisions and shows investors or partners that you have a clear plan for success.

In this section, focus on these simple points:

- The size of the tax preparation industry

- Who your target clients are

- What your clients need help with, like personal or business taxes

- Current trends in tax services

- Competitors in your area or online

Knowing your target market helps you serve your clients better, meet their needs, and stay ahead of the competition. This section shows you understand the industry and how you plan to grow your business.

“At first, looking into other tax prep businesses felt like a lot—there were so many already offering similar services.

To make it easier, I created a simple comparison chart to track their services, pricing, and client feedback. That’s when I noticed the gaps—like limited personalized support, slow response times, or a lack of year-round services.

I used those weak spots as opportunities to show how my business could offer something better and stand out in the market.” —Natalie Cunha

5. Competitive Analysis

In this competitive analysis section, you’ll look at other tax preparation businesses that offer similar services. This helps you understand how your business compares and what makes you different.

Start by identifying your competitors. Are they local tax offices, online tax services, or independent tax preparers? Check their services, prices, and reviews to see what they do well and what they lack.

Then, think about their strengths and weaknesses. For example, a competitor might offer quick online services but lack personal support, or they may have strong branding but charge higher fees.

By knowing this, you can offer something better or unique.

Consider what sets you apart — like personalized tax advice, flexible pricing, faster service or support all year round.

“While researching my competitors, I noticed that many offered similar tax preparation services, but few focused on personalized support and ongoing financial guidance.

This made me realize that building strong client relationships and offering year-round advice could set my business apart.

By understanding what worked—and what didn’t—for others, I found ways to create a unique experience for my potential clients and carve out my own space in the market.”—Natalie Cunha

6. Sales and Marketing Plan

This section explains how you’ll get clients, encourage them to use your tax services, and keep them coming back. It’s all about simple ways to grow your business.

Sales strategy:

- Offer free consultations to understand clients’ tax needs.

- Provide flexible prices or special packages for individuals and small businesses.

- Give great customer service by answering questions, following up, and offering helpful advice.

Marketing strategy:

- Use clear photos and videos to show your services online.

- Make your website easy to find with simple SEO and local business listings.

- Post on social media to share tax tips, deadlines, and offers.

- Work with local businesses and financial advisors to get referrals.

This plan shows how you’ll bring in new clients and build strong relationships with them over time.

“Building a strong marketing plan took planning and effort.

Connecting with local clients helped build trust, and partnering with small businesses and financial advisors brought in more referrals.

Providing clear communication and dependable service became our biggest asset.

We also focused on community outreach and local advertising to keep our tax preparation business visible and growing.” —Natalie Cunha

7. Operations Plan

The operations plan explains the daily tasks needed to run your tax preparation business smoothly while giving clients great service.

Think about these questions when creating this section:

- Will you serve in person, online, or both?

- How will you keep track of client records, tax documents, and filings? Will you use tax software or cloud systems?

- What jobs will your team have, like tax preparers, office staff, or virtual assistants?

- How will you schedule client appointments? Will you use booking software or an online calendar?

- Who will handle software updates, office supplies, and technology needs?

Answering these questions will help you create a simple plan to stay organized and provide reliable service to your clients.

“I realized how important it is to keep things organized — from managing client appointments to handling tax documents — when setting up my operations plan.

I created a simple system to track bookings, client records, and software updates, making it easier to stay on top of everything and provide smooth, reliable service.

It’s not just about preparing taxes — it’s about having the right processes in place to keep the business running well and clients happy.”—Natalie Cunha

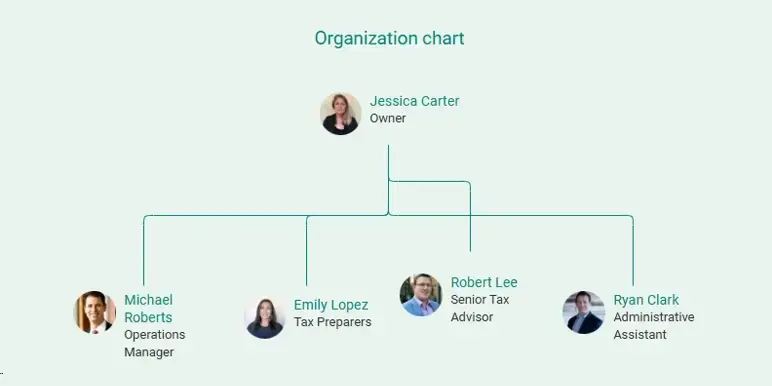

8. Management Team

This section highlights the key people who will help run your tax preparation business.

Whether you’re a solo operator or have a small team, a clear management structure gives investors confidence and keeps your business organized and profitable.

Start by introducing yourself. Share your background, education, tax prep experience and the skills that qualify you to run the business.

If you have a team, list their roles and responsibilities - like preparing tax returns, managing client appointments, customer service, daily operations, etc.

You can also include an organizational chart to show how everyone works together and who reports to whom.

If you have advisors, like financial experts, certified public accountants, or business consultants, mention them too. It shows that your business has professional support and guidance to help it grow.

"Creating a strong management team for my tax preparation business wasn’t just about assigning roles — it was about bringing together people who share my commitment to accuracy and client service.

Having a dependable team ensured daily operations ran smoothly, giving me the freedom to focus on growing the business, knowing that clients were in good hands." —Natalie Cunha

9. Financial Plan

Your financial plan is key to securing investors and ensuring the long-term success of your tax preparation business. It shows how you will make money and keep expenses controlled.

Typically, the financial plan includes actual projections for revenue, expenses, and profit over the next 3-5 years.

Here are the main financial statements and reports to include:

- Income statement (profit and loss statement)

- Cash flow statement

- Break-even analysis

- Balance sheet

- Funding requirements

- Risk management plan

Also include rough estimates of startup costs and expected revenue. Explain how you plan to raise money—whether through personal savings, loans, or investors.

Next, clearly outline how the funds will be used, such as:

A good financial plan shows investors you have a clear and structured plan to grow the business and stay profitable.

“Financial planning involved calculating expenses, setting a budget, and projecting revenue while considering the uncertainties of the tax business.

Using financial tools and tax preparation software was a game changer—it streamlined organizing costs for software, marketing, and staff, while also helping create clear cash flow statements and future projections.”—Natalie Cunha

Download free tax preparation business plan sample

Looking to create your tax preparation business plan but need a bit of guidance? We’ve got you covered!

Download our tax preparation business plan PDF to kickstart your journey.

This investor-ready template has helped many tax professionals craft effective plans. Packed with practical examples and expert tips, it makes the process simple and ensures you include all the essential details.

Conclusion

Now that you’ve gone through this guide, creating a clear and simple business plan for your tax preparation business should be much easier.

But if you still feel stuck or need expert help, our business plan consultants are ready to assist you. They can guide you with writing, reviewing, and making realistic financial projections tailored to your business.

Don’t wait—contact us today!

Frequently Asked Questions

Do I need a business plan for my online tax preparation services?

Yes, a business plan helps you stay organized by clearly outlining your goals, services, prices, and how you’ll find target customers. It also helps if you want to get support or funding.

What funding sources do I consider to start a tax preparation company?

To start a tax preparation company, you can consider these funding sources:

- Personal savings

- Small business loans

- Grants

- Investors

- Crowdfunding

- Family and friends

Choose what fits your situation best!

How to build realistic financial projections for my plan?

To build realistic financial projections:

- Guess your income: Number of clients × your fees.

- List your costs: Software, marketing, office supplies, etc.

- Find your profit: Income minus costs.

- Plan for different outcomes: Best, worst, and average cases.

- Use simple tools: Like spreadsheets or apps.

Start small and update as you go!

What could be the easiest way to write a business plan for tax preparation?

You can write a tax preparation business plan yourself, but it takes a lot of research and detailed analysis. A business plan template can make it easier by giving you a clear structure. For an even quicker way, business plan software helps create a professional plan in minutes with step-by-step guidance.

How much do tax preparers charge for their services?

Tax preparers charge based on the complexity of the return. Simple returns may cost around $220, while more detailed filings with itemized deductions or business income can range from $400 to $800 or more. Fees also depend on the preparer's qualifications and location.