Starting and running your own pharmacy could be a great opportunity to support your community’s health and well-being every day.

But turning that dream into reality takes more than stocking shelves with prescriptions and products—you need a clear, actionable business plan that makes a difference.

Well, writing a plan might feel overwhelming at first. Even Brandon Knott, the owner of Cascade Specialty Pharmacy, felt the same when he started his journey.

Recently, I had a conversation with Brandon about how he built a successful pharmacy while navigating the potential hurdles. From those insights, I’ve prepared this guide just for your help and inspiration.

What is a pharmacy business plan?

A pharmacy business plan is a professionally crafted document that serves as a strong foundation for launching and growing your pharmacy. It outlines your unique concept, key objectives, marketing strategies, and financial projections—all in a clear and structured format.

In simple terms, it’s a strategic roadmap to keep your pharmacy organized, navigate potential challenges, and achieve long-term success.

Why do you need a business plan for pharmacy?

Whether you’re starting a new pharmacy or already have experience in the industry, a business plan is a must.

Here's why it matters:

- Helps set clear goals whether you’re focusing on one pharmacy or planning for future growth.

- Shows investors or lenders that you have a solid plan and a vision for the business.

- Lets you secure funding by showing a solid strategy, so investors believe in your pharmacy’s success.

- Allows you to plan for challenges like competition or regulatory changes and come up with solutions.

- Helps you track the progress by comparing sales and expenses to your projections so you can adjust operating costs as needed.

In short, a good business plan keeps your business focused and adaptable.

How to write a pharmacy business plan?

When drafting a business plan for a pharmacy, it’s very important to focus on key components to communicate your vision and strategy.

Here’s a simple guide to help you create a strong and effective business plan:

1. Executive summary

The executive summary is a short intro to your pharmacy business plan, giving an overview of what your pharmacy is all about and what sets it apart.

Although it’s the first section of your plan, it’s best to write it last as it best summarizes the key points from the rest of your plan.

Here’s what to include in your pharmacy business plan summary:

- Business name and location

- Founders or key partners

- Mission and vision

- Market opportunities and target audience

- Unique selling points

- Financials projections outlook

The purpose of your executive summary is to grab the reader’s attention and make a great first impression. Hence, keep it short, simple, and informative.

“Writing the executive summary for Cascade Specialty Pharmacy was harder than I thought—it’s tough to condense our business into a few sentences.

I started by identifying the main parts of our business and our competitive advantage, then customer care and quality.

After several drafts, I had a summary that truly reflects our independent pharmacy and the value we offer to our customers, so I’m good to move forward with the rest of our business plan.”—Brandon Knott

2. Company description

This section introduces your pharmacy and its foundational details. It helps you establish a clear, professional image of your pharmaceutical business with readers.

When you write this section, consider answering these questions:

- Where is your pharmacy located and why did you choose this location?

- What are the short-term goals of your pharmacy and where do you see it going long term?

- Do you have a retail, compound, or specialty pharmacy?

- Are you a sole proprietor, LLC, or partnership?

- What is the purpose of your pharmacy and the values behind it?

- How did you start this business? Tell the story behind it and how it came to be.

- What milestones have you achieved so far?

Further, explain the regulatory requirements and legal rules for a pharmacy and how you will comply with them.

In short, this section gives the reader a snapshot of your business and helps build trust. So, try to keep it simple, real, and to the point.

"Describing Cascade Specialty Pharmacy wasn’t easy at first. I had to figure out what made our services unique and how to structure everything.

Once I nailed down our vision, mission, and focus on quality customer service everything fell into place.

Clarifying our legal structure and setting clear goals—short and long term—gave me the foundation to move forward with confidence.”—Brandon Knott

3. Industry and market analysis

Before you open your pharmacy, figure out where you fit in the pharmacy market as it helps you identify your target customers, and competitors while building a successful business.

So, conduct a thorough analysis and identify the recent pharmacy industry trends. Explain how you’re going to meet them and set a position for your pharmacy in the market.

Next, define your target customers. Are they seniors, families, or busy professionals? What are their pain points and how does your pharmacy solve them? Knowing your target customers makes marketing easier.

Further, do an effective SWOT analysis for your pharmacy. What are your Strengths, Weaknesses, Opportunities, and Threats? For instance:

This will help you know what sets you apart, areas to improve, opportunities to grow, and risks to be aware of.

Finally, think long term. Is the market big enough for your goals? Are there chances to grow in the future? Keeping a solid plan will help you succeed.

"One of the challenges in the pharmacy industry analysis was identifying the right customer. I needed to understand who in the community would benefit most from my services and what healthcare needs mattered to them.

By digging into local demand and patient feedback, I started to see clear patterns. This helped me focus my pharmacy’s offerings and better serve my target audience." — Brandon Knott

4. Competitive analysis

Competitive analysis helps you know who your competitors are and what makes your pharmacy different.

Start by looking at other pharmacies in your area. Analyze their location and services offered. How do you compare to them?

Explore their pricing strategies—are they cheaper or more expensive? Where and how do they promote their pharmacy—through social media, local ads, or healthcare partnerships?

If needed, read reviews from their customers to see what they like or dislike. This will help you see where you can improve and offer a better experience.

By knowing what your competitors are doing, you can offer something different and get more customers to your pharmacy. Will you offer personalized services, competitive pricing, or unique health programs?

"Looking at other local pharmacies helped me see what was missing.

Most just focused on prescription medications, but they didn’t emphasize personalized service, health education, or strong connections with local healthcare providers. So, I made those my priority.

By building a pharmacy business that’s supportive, community-driven, and centered around customer needs, I’ve created a place where people trust our care and keep coming back."—Brandon Knott

5. Products and services

Now, list out the products and services your pharmacy will offer and what makes them valuable to your customers.

To plan this section effectively, consider including these key details:

- Main products: List the key products your pharmacy will offer, such as prescription drugs, over-the-counter drugs (OTC), and vitamin supplements.

- Services: Outline the services you provide, like medication counseling, home delivery, and prescription refills. Briefly mention how you ensure quality with skilled pharmacists and reliable service.

- Pricing: How will you charge? By medication type, package deals, or discounts for repeat customers.

- Future expansion: Mention any future services you’ll provide like health screenings, online ordering, or home health support.

If you offer additional services like custom-compounded medications or patient education focus, highlight them as well. This shows how you meet customer needs and make your pharmacy stand out.

"Defining our pharmacy services meant showing how our personalized customer care and specialized services met the needs of our target market.

By prioritizing services like prescription drugs, over-the-counter medications, and home delivery I was able to show what sets us apart from other pharmacies in the area.."—Brandon Knott

6. Sales and marketing strategy

This section is all about how you’ll attract customers, encourage them to visit your pharmacy and keep them happy. It focuses on easy and effective ways to grow your pharmacy business.

Here are some strategies you may include in your sales and marketing plan:

Sales strategy:

- Offer consultations to help customers with their health and medication needs.

- Provide flexible pricing and special deals to suit different budgets.

- Keep a friendly team to answer questions, follow up with customers, and provide great service.

Marketing strategy:

- Use clear, high-quality photos and videos to showcase your pharmacy’s products and services online.

- Make your website easy to find with SEO optimization and local business listings.

- Post regularly on social media to share health tips and special offers to connect with customers.

- Work with local healthcare providers and professionals to build a referral network.

Overall, your sales and marketing plan section should be about how you'll bring in more customers and grow your loyal customer base.

"Crafting a strong marketing plan required both strategy and persistence.

Engaging with local customers helped build trust, while partnerships with local healthcare providers boosted referrals. Our commitment to superior customer service became our biggest strength.

We also invested in community outreach and local advertising to keep our pharmacy business top of mind."—Brandon Knott

7. Operations plan

The operations plan will detail how your pharmacy will run on a daily or weekly basis. This will give readers a better understanding of all your business operational intricacies.

The following are a few essential details to include in this section:

- Daily operations

- Staffing and training

- Technology or tools used

- Client relationship management

- Inventory and supply management

By covering these details, you’ll show investors that you’ve thought through all the practical aspects of running the pharmacy efficiently while providing the best service to your customers.

"Mapping out the business operations plan required looking at every detail, from staffing licensed pharmacists and pharmacy technicians to maintaining compliance with industry regulations.

Breaking it into clear steps made it easier to develop a strong, actionable strategy that ensures our pharmacy business runs smoothly and efficiently."—Brandon Knott

8. Management team

Your management team is the key to your pharmacy’s success. Investors and partners aren’t just backing your idea, they're backing the people who will make it happen.

Start writing this section by introducing the key team members and their roles in the pharmacy. Talk about their experience and achievements—a lead pharmacist with years of patient care experience, and a manager who knows how to run a pharmacy smoothly.

Explain how their skills make them the right fit to grow your business. Focus on how they’re qualified to make the pharmacy a trusted place for customers.

If you have mentors or advisors mention them too. It shows investors that you have the external support to run the business well.

"When I first started, it was just me and a couple of pharmacy technicians handling the basics. I quickly realized I couldn’t do it all alone.

With guidance from my mentors, I focused on key roles—hiring licensed pharmacists and outsourcing tasks like marketing.

This helped me balance running a lean pharmacy at the start while planning for growth as our customer base expanded."—Brandon Knott

9. Financial plan

Your financial plan for the pharmacy business is critical for securing investors and ensuring long-term sustainability and growth. It clearly shows how your pharmacy will generate income while managing expenses over time.

Typically, the financial plan provides realistic projections on revenues, costs, and profits for the first 3 to 5 years.

Here are the essential financial statements and reports to include in your pharmacy financial plan:

- Income statement (profit and loss statement)

- Cash flow statement

- Break-even analysis

- Balance sheet

- Funding requirements

- Risk management plan

In addition, provide approximate figures for your start-up costs and revenue projections as well as how you plan to raise funds.

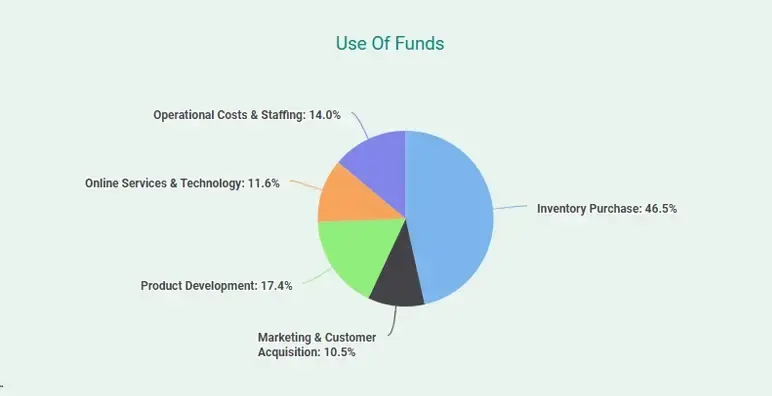

Also, explain how the funds will be used—whether for purchasing inventory, marketing, expanding store locations, or enhancing online services—to provide a clear breakdown of spending priorities. For example:

A comprehensive financial plan will assure investors that you have a clear, well-structured strategy to achieve revenue goals and maintain profitability.

"Financial planning felt overwhelming at first—calculating operating expenses, setting a marketing budget, and projecting revenue while accounting for the pharmacy market’s unpredictability.

However, using financial planning software made a huge difference. It helped me organize costs for inventory, advertising, and staff salaries, and create clear cash flow statements and long-term projections."—Brandon Knott

Download free pharmacy business plan template

Ready to develop your pharmacy business plan but need some extra support? We’ve got you covered! Download our pharmacy business plan template in PDF to jump-start your journey.

This investor-friendly template has helped many pharmacy owners create successful plans. I hope it does to you as well. With clear examples and useful tips, it makes writing your pharmacy business plan easier than ever.

Get help writing your business plan

Now that you’ve explored this guide, creating your pharmacy business plan should be much simpler.

If you need expert guidance, our experienced business plan consultants are ready to help. They’ll offer valuable insights and assist you in refining your plan to align with your unique business goals.

Get a quote today and take the next step toward success.

Frequently Asked Questions

What key components should be covered in a successful pharmaceutical business plan?

The key components that should be covered in a successful pharmaceutical business plan are:

- Executive summary

- Company description

- Industry and market analysis

- Competitive analysis

- Products and services

- Sales and marketing strategy

- Operations plan

- Management team

- Financial plan

How do I attract investors and secure funding for my pharmacy?

To attract investors and secure funding for your pharmacy, follow these steps:

- Create a solid business plan, highlight unique services, and build a strong brand.

- Reach out to investors through networking sites, events, and online platforms.

- Explore funding options like traditional bank loans, government grants, and crowdfunding platforms.

Show accurate financial projections and growth plans to prove your pharmacy is a good investment and will make a profit.

Where can I find a free pharmacy business plan sample?

You can find free pharmacy business plan samples on reputable websites like Upmetrics, Bizplanr, Liveplan, Bplans, or PlanBuildr.

Is it beneficial to hire a consultant for business plan writing?

Yes, hiring a consultant for business plan writing can be beneficial as they help create a professional, well-structured plan that attracts investors. However, if you're on a tight budget, using a pharmacy business plan template or online software can be a more affordable way to draft your plan.

What licenses and permits are needed to start a new pharmacy?

To start a new pharmacy, you’ll need:

- Business operating license

- Pharmacist license

- DEA registration

- NPI number for insurance billing

- Retail seller’s permit

Check with your state’s Board of Pharmacy for specific requirements.